Jio’s bid to win the business and cloud markets

24 September, 2020•6 min

0

24 September, 2020•6 min

0

Getting your Trinity Audio player ready...

Why read this story?

Editor's note: In January, Bharti Airtel Ltd, India’s second-largest telecom operator, first stitched together an agreement with Google Cloud, under which Airtel was to offer G Suite products, including Gmail, Docs, Drive and Calendar, to large, medium and small businesses. At the time, Airtel’s enterprise business comprised 2,500 large businesses and a little over 500,000 small businesses and startups, according to a press release by the company. Seven months later, in August, Airtel inked a multi-year partnership with Amazon Web Services to make most of its business customers switch to AWS’s cloud computing platform. Airtel’s announcement stated that the company served, in addition to over 2,500 large businesses, a little more than a million small and medium businesses and startups. So in this period, going by Airtel’s statements, it doubled its small-and-medium client base. At the same time, Airtel also made investments in four startups—Waybeo, Lattu Kids, Voicezen, and Spectacom. Finally, Airtel also got a $235 million investment from Carlyle Group Inc. in its data centre business, as the US-based private equity investor acquired a 25% stake in Airtel’s data centre business, …

More in Business

Business

Ajay Singh’s SpiceJet turnaround story is running on fumes

As much as he would like to convince investors about the airline’s prospects, it’s increasingly clear the low-cost carrier is just about managing to stay afloat.

You may also like

Business

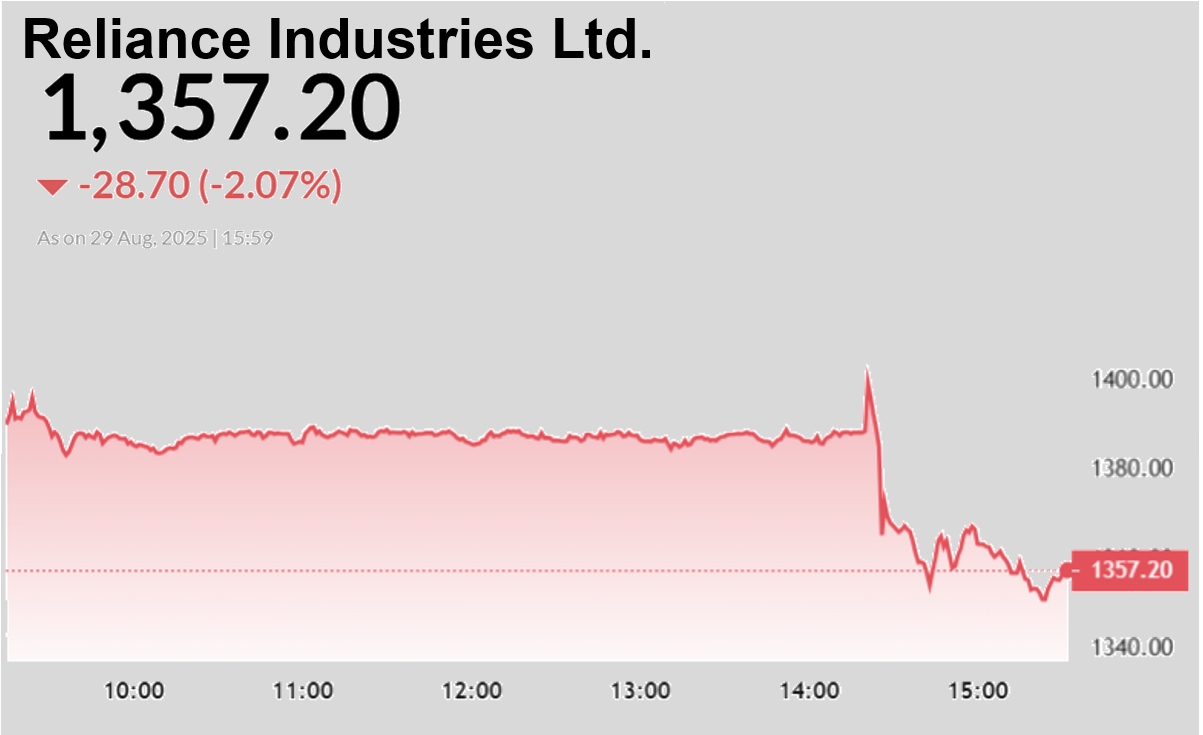

Reliance’s growth engines may be losing steam

Telecom and retail, which account for half the conglomerate’s revenue and most of its valuation, aren’t accelerating fast enough to justify their price tags.

Business

Conglomerates, duopolies and domination hamper India

The domination of a few business groups—conglomerates—is a defining feature of the country’s economy. This has been enabled by policy, leading to stifled innovation and hindered progress. All of this, in turn, exacerbates inequalities.

Business

An uneventful Reliance AGM that could not have been otherwise

Everyone seems to be disappointed with the company’s annual general meeting. With hands full and businesses that need further nurturing, this was not the time for big-bang announcements. And so it was.