Why the government should do an IPO for NPCI

17 September, 2020•7 min

0

17 September, 2020•7 min

0

Getting your Trinity Audio player ready...

Why read this story?

Editor's note: India’s Unified Payments Interface, or UPI, has gained name and fame across the world—perhaps for the first time that Indian tech has been hailed for developing an innovative platform, as opposed to software services. Launched by the National Payments Corporation of India, or NPCI, in 2016, the instantaneous digital payments platform has witnessed a stunning growth, from processing Rs 3 crore worth of transactions in August 2016 to Rs 3 lakh crore in August 2020. In just four years, UPI alone accounts for close to 50% of all retail payments processed in India, in terms of transaction volumes. UPI may have attracted many a plaudit to NPCI, but the fact is that the non-profit company, which manages most retail payments systems in the country, is credited with launching a number of other platforms. These include the Immediate Payment Service, the RuPay card network, the Bharat Bill Payment System, the Aadhaar-enabled Payment System and FasTAG. Licensed by the Reserve Bank of India and controlled by a consortium of state-owned and private-sector banks, NPCI was set up in 2008 to operate retail …

More in Business

Business

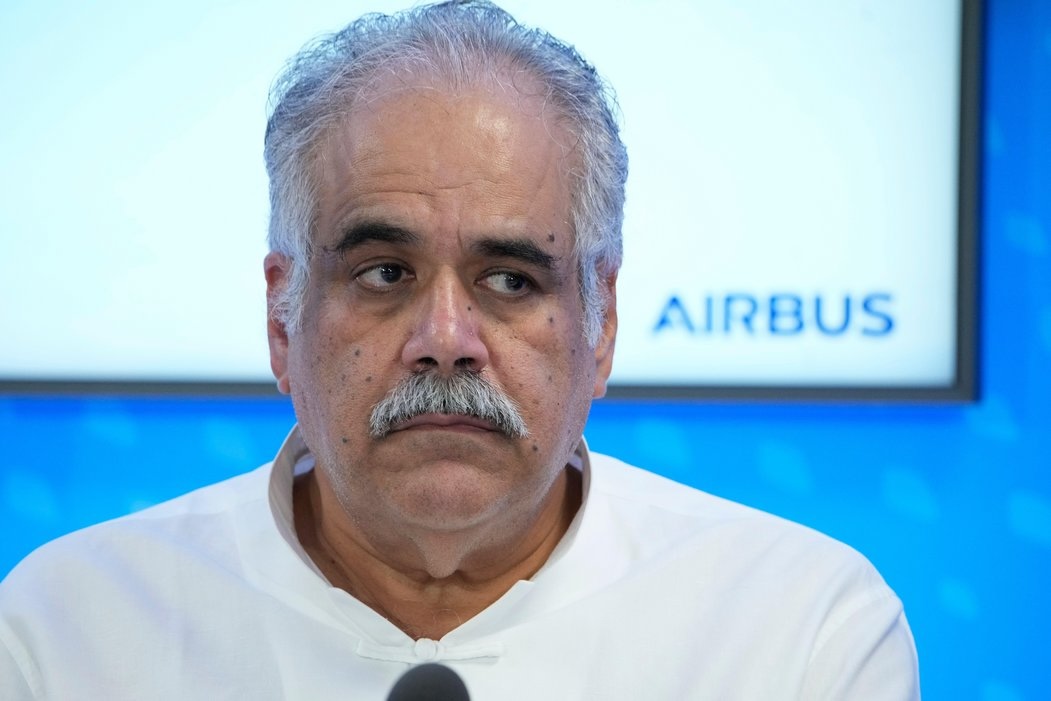

Rahul Bhatia is IndiGo’s good, and bad, news

Investors have backed the founder’s move to ease out the airline’s CEO and take charge in the interim. But they should be worried about the airline’s dependence on him.

You may also like

Business

The Rs 590-crore blame game at IDFC First Bank

Divergent narratives from the Haryana government and the lender raise deeper questions on oversight, authorizations and systemic lapses—answers that may emerge only after a forensic audit.

Business

Exclusive: Jana Small Finance Bank to reapply for universal bank licence in May

The Bengaluru-based lender is once again gearing up to seek the RBI’s nod after the central bank returned its application last year.

Business

CSB Bank’s deposits are a ticking time bomb

The Kerala-based bank has been chasing costly and risky bulk term deposits amid tanking profitability.