Adani repays loans against pledges in face-saving move

The group has made early payments on debt set to mature late next year in an attempt to reduce the number of shares pledged by the promoters.

6 February, 2023•4 min

0

6 February, 2023•4 min

0

Getting your Trinity Audio player ready...

Why read this story?

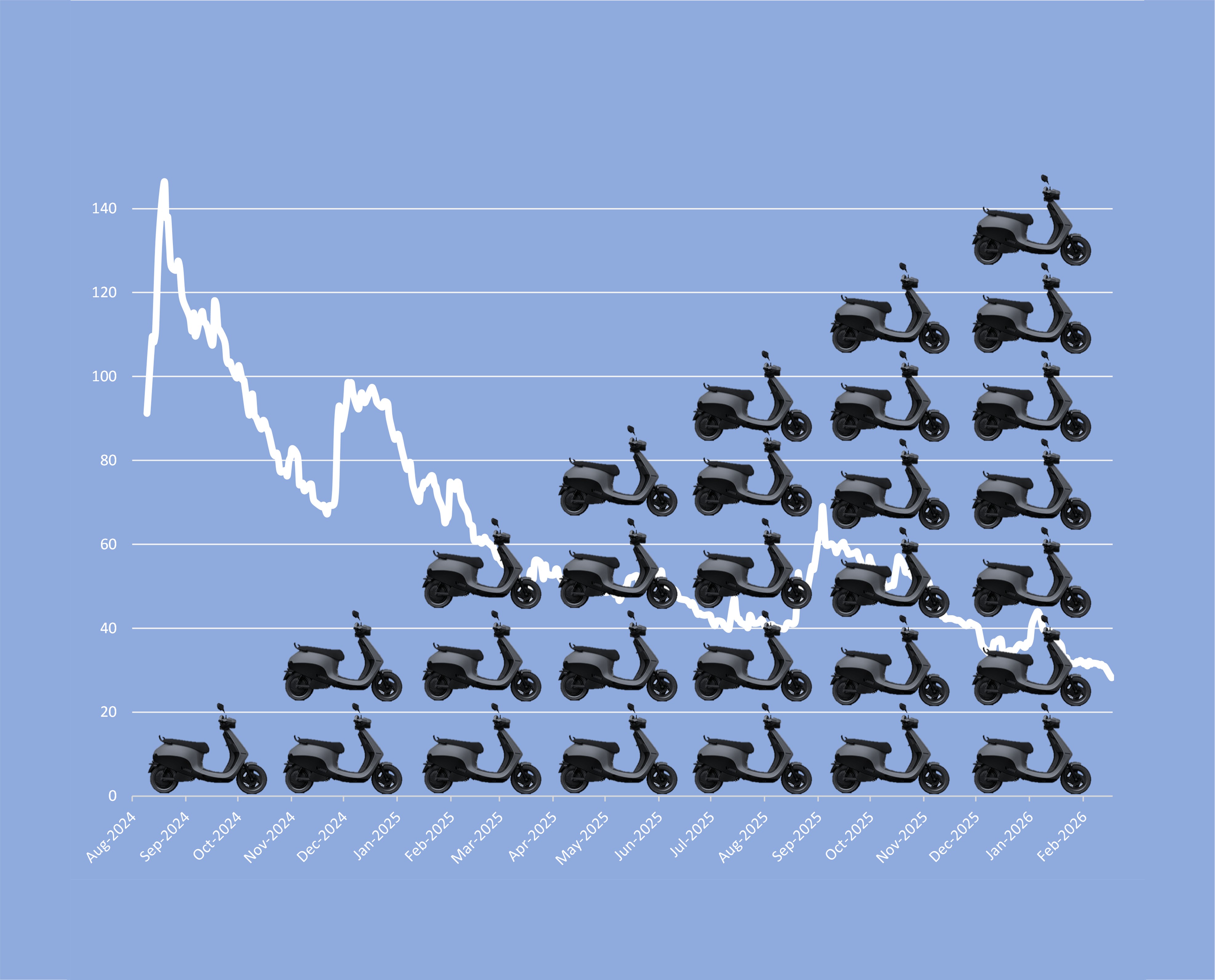

Editor's note: The Adani group has repaid over Rs 9,400 crore, or $1.11 billion, worth of loans that were borrowed against shares of the conglomerate’s listed entities. The loans were repaid ahead of their maturity of September 2024, according to a company statement. Nearly two weeks have passed since US-based short seller Hindenburg Research released its report against the Adani group. The group’s stocks have since tanked in the local markets, losing more than 47% of their value from $226.7 billion to $120.6 billion. Dollar bonds issued by the group continue to trade at a discount on international exchanges. Promoters of corporations use their shares as collateral in order to borrow money from banks and other lenders. At the Adani group, pledging shares for loans has always been high, but over the last few years they have brought down the share. The Adani group has around Rs 42,900 crore, or $5.2 billion, of pledged stake value, according to JP Morgan. Source: Adani Portfolio January 2023 Global Call Short Seller Response By repaying loans borrowed against pledged shares, a number of shares will …

More in Business

Business

Exclusive: Jana Small Finance Bank to reapply for universal bank licence in May

The Bengaluru-based lender is once again gearing up to seek the RBI’s nod after the central bank returned its application last year.

You may also like

Business

Why Adani Green’s rapid expansion is hurting its bottom line

The renewable energy firm’s profit plunges 99% to its lowest since 2020 as surging finance costs erase gains from record energy sales.

Business

Reliance’s growth engines may be losing steam

Telecom and retail, which account for half the conglomerate’s revenue and most of its valuation, aren’t accelerating fast enough to justify their price tags.

Business

Ten business developments for 2026

Who’s going to lead the IPO party, what’s going to drive the market, where are some of the leading businesses headed, and more.