Hindenburg's three big allegations against the Adani group

The US-based investment firm says it holds short positions in the conglomerate.

25 January, 2023•3 min

0

25 January, 2023•3 min

0

Getting your Trinity Audio player ready...

Why read this story?

Editor's note: Hindenburg Research has accused the Adani group of stock manipulation, accounting irregularities and misappropriation of funds. All nine group stocks listed on the stock exchanges are trading in the red, after the US-based activist investment firm published its report on Wednesday. Hindenburg says the group’s listed companies had “substantial debt”, putting it on a “precarious financial footing”. The firm disclosed that it holds short positions in the group through “US-traded bonds and non-Indian-traded derivative instruments”. “Even if you ignore the findings of our investigation,” says the report, the group’s “key listed companies have 85 per cent downside purely on a fundamental basis owing to sky-high valuations”. Over the past two years, the market capitalization of the Adani group’s nine stocks has grown more than 6x to over $226 billion (Rs 18.42 lakh crore). The group’s flagship entity, Adani Enterprises Ltd, is in the midst of raising up to Rs 20,000 crore in fresh equity capital to fund its road construction, solar power and airports verticals. Based on a two-year investigation into the group, the firm made several allegations. Following are …

More in Business

Business

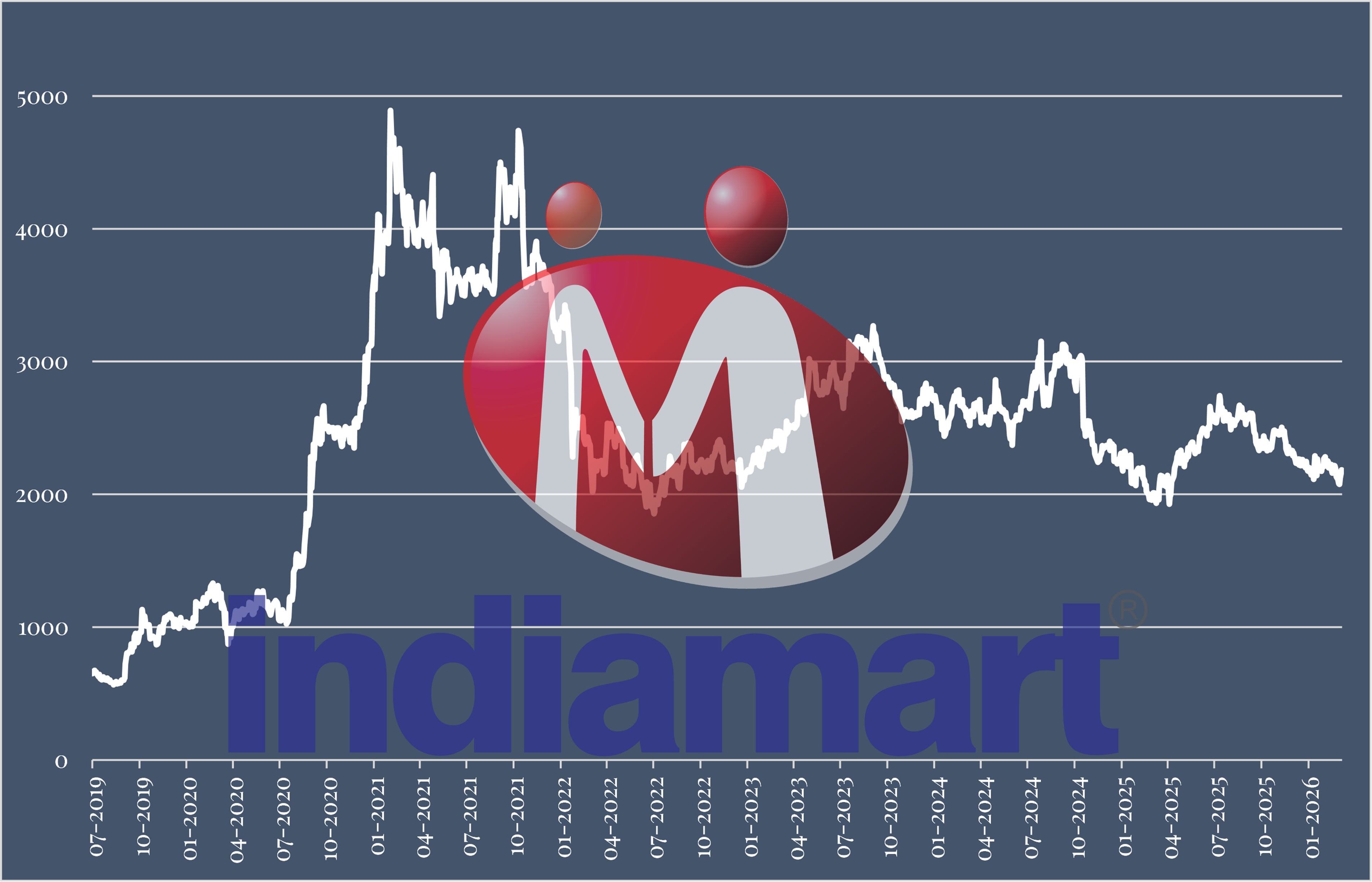

Does IndiaMART’s stock price really mirror its business reality?

The B2B marketplace has done almost everything right, attracting value investors like Pulak Prasad. Yet, the stock continues to languish.

You may also like

Business

SEBI’s overdue expansion is underway, but top-level gaps persist

India’s market regulator is looking to ramp up hiring at the entry level. But what really needs attention is the constant uncertainty at the top and the lack of domain experts.

Business

Can Adani pull off the 100% green AI promise?

The group’s $100 billion data centre push rests on solving clean energy’s toughest constraint: consistent, real-time renewable supply at scale.

Business

Why Adani Green’s rapid expansion is hurting its bottom line

The renewable energy firm’s profit plunges 99% to its lowest since 2020 as surging finance costs erase gains from record energy sales.