How long can Ajay Srinivasan stay at Aditya Birla Capital?

Amid wealth erosion, sluggish growth, management churn and constant controversies, the CEO’s days might just be numbered.

24 November, 2021•13 min

0

24 November, 2021•13 min

0

Getting your Trinity Audio player ready...

Why read this story?

Editor's note: Kumar Mangalam Birla’s losses in the telecom business are well documented. Compared to that, the damage from his Aditya Birla Group’s financial services play may be less spectacular. But in the past four years, the value of the group’s holdings in Aditya Birla Capital have fallen more than Rs 23,000 crore. At the same time, Aditya Birla Capital CEO Ajay Srinivasan has been paid a total of more than Rs 100 crore in the same four years. Srinivasan has little to show for his 14-year stint at the helm of the financial services business of one of the oldest conglomerates in India. Apart from the wipe-out of shareholder wealth, the company has struggled with a loss of market share, allegations of corruption, scrutiny from investigative agencies and a high level of attrition at the top. In February this year, company secretary Sailesh Kumar Daga had stepped down followed by Maneesh Dangi, chief investment officer of debt at Aditya Birla Sunlife Mutual Fund, in March. Since May, at the shadow banking business of the group, the chief financial officer and the …

More in Business

Business

SEBI’s overdue expansion is underway, but top-level gaps persist

India’s market regulator is looking to ramp up hiring at the entry level. But what really needs attention is the constant uncertainty at the top and the lack of domain experts.

You may also like

Business

Reliance’s growth engines may be losing steam

Telecom and retail, which account for half the conglomerate’s revenue and most of its valuation, aren’t accelerating fast enough to justify their price tags.

Business

Jio Financial is learning from Bajaj Finserv and that should worry Aditya Birla Capital

Alongside a decent set of numbers, the Mukesh Ambani-helmed financial services co. has articulated a long-term playbook that could reshape the competitive landscape of financial services.

Business

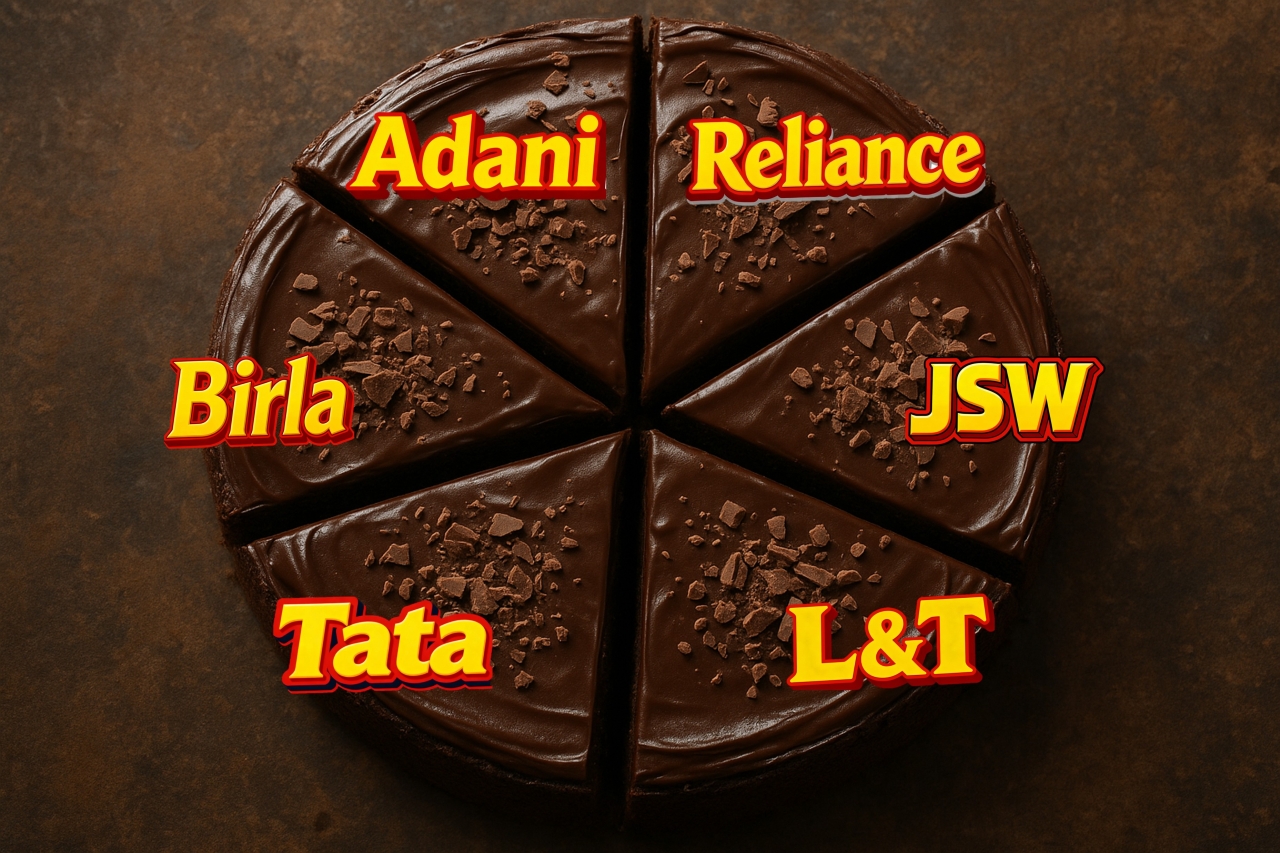

Conglomerates, duopolies and domination hamper India

The domination of a few business groups—conglomerates—is a defining feature of the country’s economy. This has been enabled by policy, leading to stifled innovation and hindered progress. All of this, in turn, exacerbates inequalities.