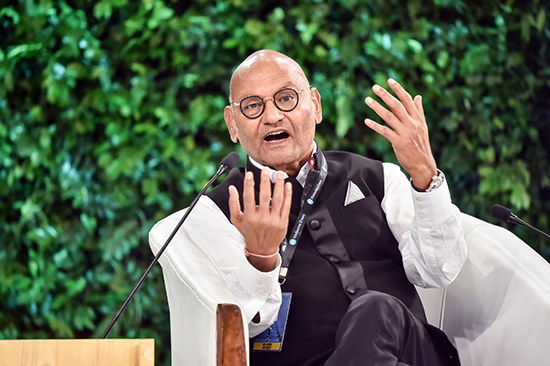

Not a Hindenburg, but Viceroy does enough to put the lens on Anil Agarwal's mining empire

Though the American short seller’s report lacks bite, it does show that Agarwal’s Vedanta Resources continues to face headwinds of several kinds.

9 July, 2025•9 min

2

9 July, 2025•9 min

2

Getting your Trinity Audio player ready...

More in Business

Business

SEBI’s overdue expansion is underway, but top-level gaps persist

India’s market regulator is looking to ramp up hiring at the entry level. But what really needs attention is the constant uncertainty at the top and the lack of domain experts.

You may also like

Business

Anil Agarwal’s Hindustan Zinc hits the sweet spot

The silver rally has helped the primary cash generator of Agarwal’s mining empire return record numbers in Q3. Investors are pleased. But a few questions linger.

Business

Ten business developments for 2026

Who’s going to lead the IPO party, what’s going to drive the market, where are some of the leading businesses headed, and more.

Business

Who after Anil Agarwal?

So far it seems unlikely that the billionaire’s two children are interested in the business. The lack of a clear succession plan brings even greater urgency to Vedanta’s restructuring exercise.