Anil Agarwal’s new yarn

Although Agarwal has clarified that investments in the semiconductor business will not be through the locally listed Vedanta Ltd, his company’s actions tell a different story.

18 August, 2022•5 min

0

18 August, 2022•5 min

0

Getting your Trinity Audio player ready...

Why read this story?

Editor's note: Earlier this year, Vedanta chairman Anil Agarwal disclosed his intent to invest in the semiconductor and electronics manufacturing business. It came as a bit of a surprise, as until then he was known only for making big bets on commodities like steel, aluminium, copper and crude oil. It looked like Agarwal—who is known to seize an opportunity when he sees one—saw a huge business potential in the shortage of semiconductor chips India was facing, and his plans squarely played into Prime Minister Narendra Modi’s call to be self-sufficient when it came to the critical piece of equipment that was wreaking havoc on supply chains for automobile and phone manufacturing companies. It also looked like the government’s announcement last December of a Rs 76,000 crore (about $10 billion at the time) scheme to boost semiconductor and display fab manufacturing in the country played a big role in piquing Agarwal’s interest. Agarwal’s plans, as always, are audacious and striking. The Vedanta group proposed an investment of $22 billion (roughly Rs 1.5 lakh crore) in two separate entities to make semiconductor and display …

More in Business

Business

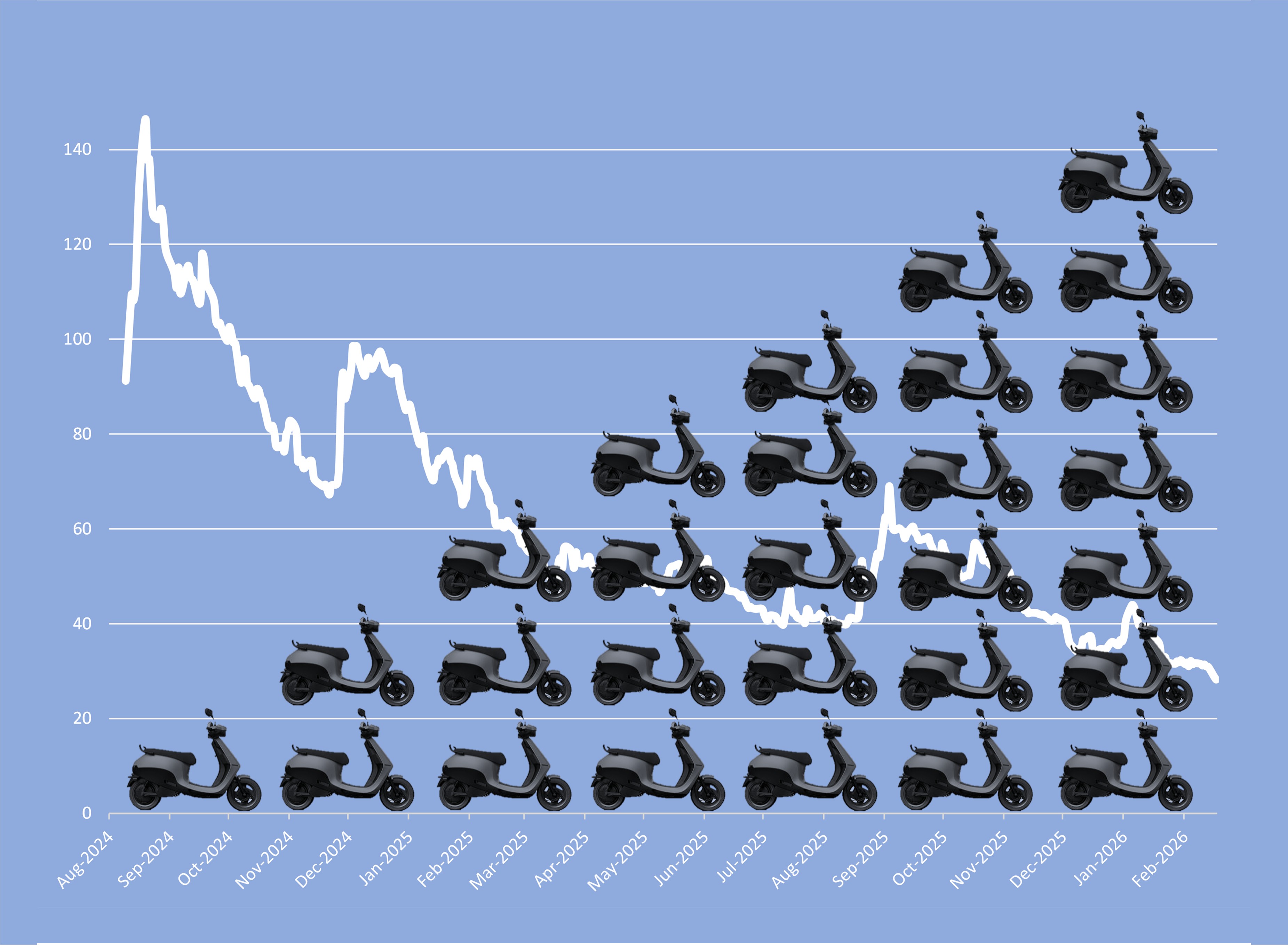

Motilal Oswal Mutual Fund’s inexplicable Ola Electric love

While its peers headed for the exit, the fund house doubled down on the falling stock. The contrarian call now looks expensive—and risky.

You may also like

Business

Anil Agarwal’s Hindustan Zinc hits the sweet spot

The silver rally has helped the primary cash generator of Agarwal’s mining empire return record numbers in Q3. Investors are pleased. But a few questions linger.

Business

Reliance’s growth engines may be losing steam

Telecom and retail, which account for half the conglomerate’s revenue and most of its valuation, aren’t accelerating fast enough to justify their price tags.

Business

Ten business developments for 2026

Who’s going to lead the IPO party, what’s going to drive the market, where are some of the leading businesses headed, and more.