Bondtech platforms gather steam amid regulatory scrutiny

Corporate bonds sound dull compared to equity and crypto, but a handful of companies are betting young investors are ready for another asset class.

3 June, 2022•15 min

0

3 June, 2022•15 min

0

Getting your Trinity Audio player ready...

Why read this story?

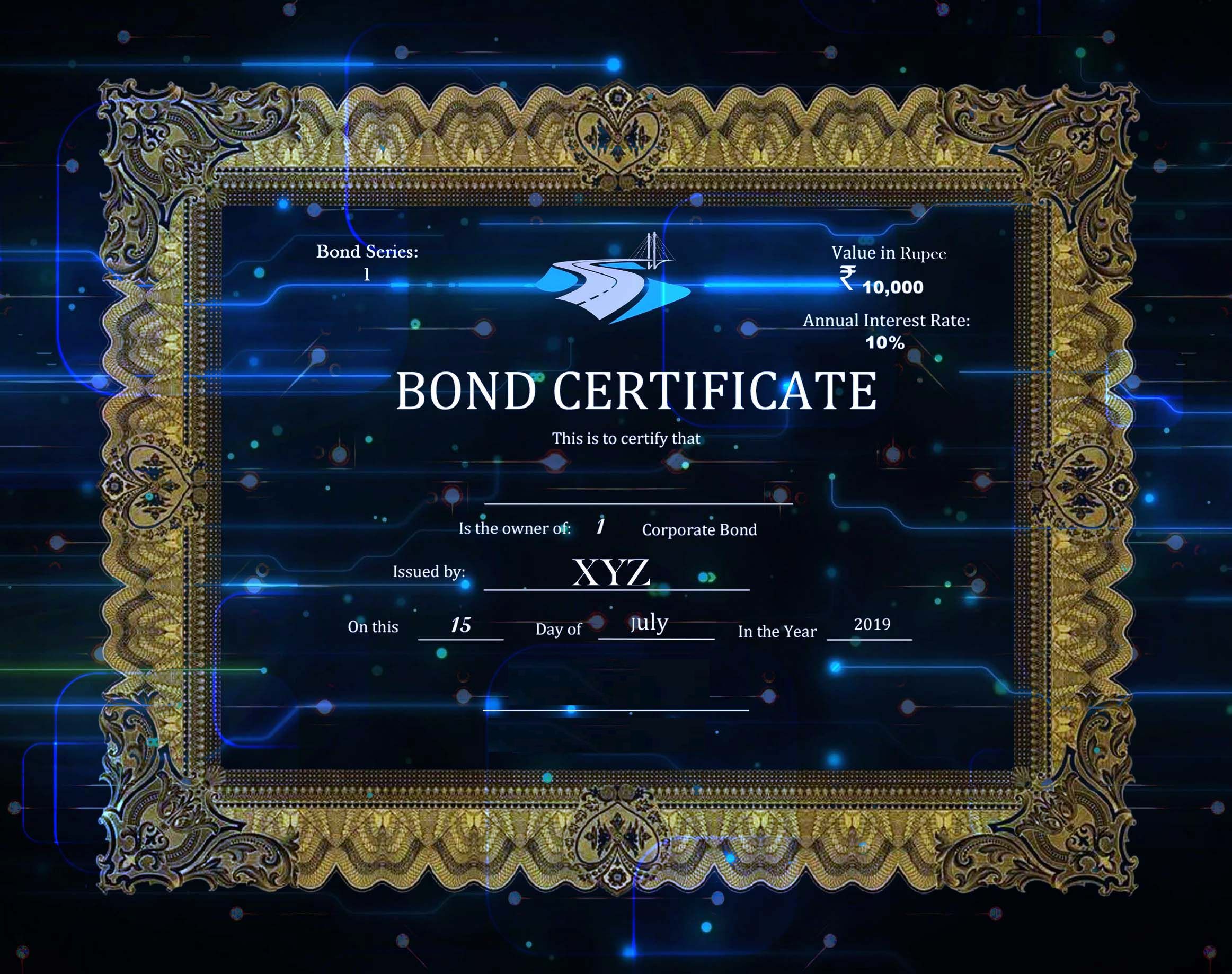

Editor's note: The past five years have seen an influx of retail investors investing directly in stocks, courtesy discount brokers and apps such as Robinhood in the US and Zerodha and Groww in India. Millions of new investors have poured into equities, driven also by rising stock prices, globally, over the past decade. But some of that exuberance is coming off given the headwinds of global inflation and high commodity prices. This shift in the global macro environment—along with fixed deposit interest rates under 6% a year at major banks—might be making another asset class more appealing: the humble bond or debenture. India’s bond markets have always been shallow, with few retail investors and high barriers for companies to raise debt this way. Both factors restrict the size of bond markets compared to equity and derivative investing. This has often been flagged as a concern by economists and financial experts, with the general refrain being that a healthy bond market would reduce companies’ dependence on bank loans. In November last year, the Reserve Bank of India launched its own platform for retail …

More in Business

Business

SEBI’s overdue expansion is underway, but top-level gaps persist

India’s market regulator is looking to ramp up hiring at the entry level. But what really needs attention is the constant uncertainty at the top and the lack of domain experts.

You may also like

Business

SEBI’s overdue expansion is underway, but top-level gaps persist

India’s market regulator is looking to ramp up hiring at the entry level. But what really needs attention is the constant uncertainty at the top and the lack of domain experts.

Business

Q3 earnings lay bare $5 billion migraine for four of India’s top banks

While the earnings have been encouraging, the real challenge lies in addressing the slowing deposit growth and leadership uncertainty.

Business

RBI wants IndusInd Bank promoters, the Hindujas, cut to size

After successive controversies and growing unease over promoter influence, the central bank is reshaping the lender—starting with management, moving to its board and tightening the screws on ownership.