On comeback trail, weight of expectations may trip up DMart

The supermarket chain seems to have turned a corner in recent months. While it has a lot going for it, a return to its glory days may still be some way off.

24 April, 2024•11 min

0

24 April, 2024•11 min

0

More in Business

Business

Is Jubilant a victim of its own success?

As a consistent performer—proved once again by its stellar Q3 FY26 results—the QSR giant runs smack dab into a market fixated on its ‘tough base’.

You may also like

Business

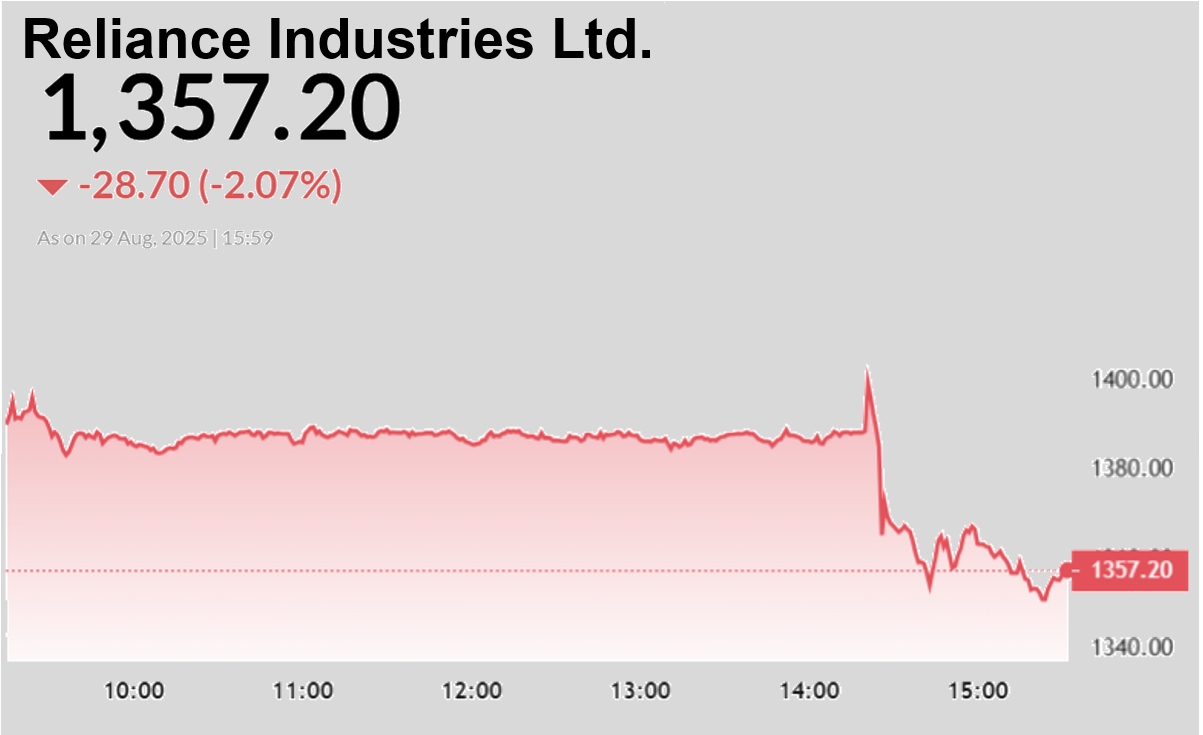

Reliance’s growth engines may be losing steam

Telecom and retail, which account for half the conglomerate’s revenue and most of its valuation, aren’t accelerating fast enough to justify their price tags.

Business

Conglomerates, duopolies and domination hamper India

The domination of a few business groups—conglomerates—is a defining feature of the country’s economy. This has been enabled by policy, leading to stifled innovation and hindered progress. All of this, in turn, exacerbates inequalities.

Business

An uneventful Reliance AGM that could not have been otherwise

Everyone seems to be disappointed with the company’s annual general meeting. With hands full and businesses that need further nurturing, this was not the time for big-bang announcements. And so it was.