Tata Power goes all in on renewables

The company plans to cut back on thermal power and put renewable energy at the front and centre of its plans. Will the bet pay off?

29 November, 2022•11 min

0

29 November, 2022•11 min

0

Getting your Trinity Audio player ready...

Why read this story?

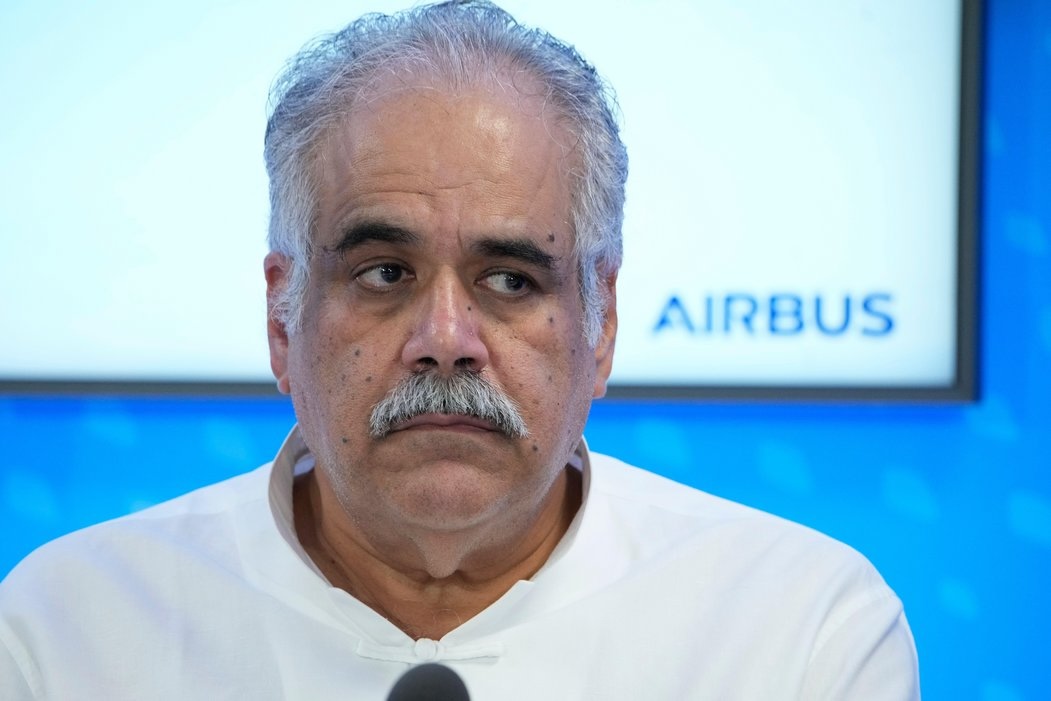

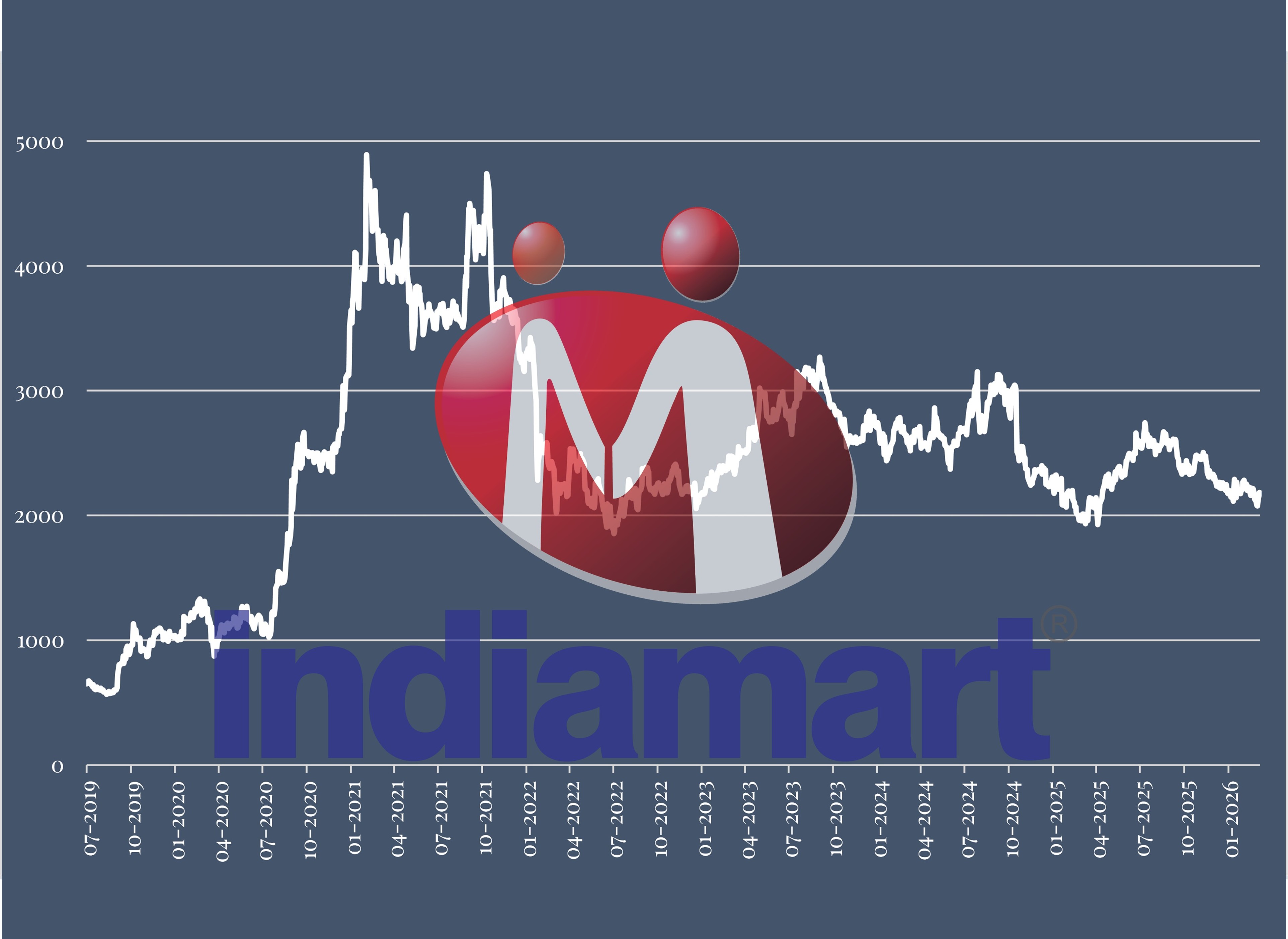

Editor's note: Praveer Sinha, chief executive and managing director of Tata Power, has given one of India’s biggest power companies a makeover. Ever since he took the reins in March 2018, the power generation arm of the Tata group has reorganized its thermal power business, is in the process of divesting dead investments and has been steadily reducing its debt. Tata Power’s revenue has grown over 60% in the past four years to about Rs 44,000 crore in 2021-22. Its net debt-to-EBITDA ratio stood at 3.5 in the September quarter of the current fiscal year as against over 7 in 2017-18 (the ratio measures a company’s ability to pay off its liabilities). Investors seem to have bought into Sinha’s vision. Tata Power’s stock has jumped 225% since 2018. The company has outperformed most of its peers, such as Torrent Power and NTPC, and even the benchmark S&P BSE Utilities index, except for Adani Green Energy, which has seen its stock jump over 6,000% since it listed in 2018. In April this year, before Tata Power announced New York-based BlackRock’s Rs 4,000 crore …

More in Business

Business

Rahul Bhatia is IndiGo’s good, and bad, news

Investors have backed the founder’s move to ease out the airline’s CEO and take charge in the interim. But they should be worried about the airline’s dependence on him.

You may also like

Business

India’s coal plants are throttling its green transition

A recent government report reveals how stubborn reliance on rigid coal plants is costing the country millions in wasted solar generation.

Business

Can Adani pull off the 100% green AI promise?

The group’s $100 billion data centre push rests on solving clean energy’s toughest constraint: consistent, real-time renewable supply at scale.

Business

Minus scooters, an empty gigafactory is squeezing Ola Electric dry

The company’s two-wheeler sales are evaporating. But its founder is reframing it as a necessary step to achieve profitability. All while trying to pivot towards becoming a company that sells lithium-ion cells instead of automobiles.