Learning to live with monopolies

As India wanders into the jaws of monopoly, the question is whether it can try to extract its pound of flesh from the monopolist.

7 February, 2022•9 min

0

7 February, 2022•9 min

0

Getting your Trinity Audio player ready...

Why read this story?

Editor's note: A spectre is haunting India—the spectre of corporate monopoly. With VI bleeding subscribers and its finances in disarray (leading to the government taking a 36% stake in the firm), and BSNL barely managing to keep its subscriber base and unable to invest further in its network, Airtel and Jio now collectively account for almost 77% of wireless subscribers and 80% of all broadband connections in the country. With mobile number portability making subscriber loyalty a thing of the past, it is not unlikely that the Indian telecom market will end up in a duopoly. This degree of industry concentration is highly reminiscent of the trajectory of American telecom in the 20th century. Please join me on a short historical detour. In the late 1800s in the US and Europe, when the telephone was first being adopted, there were often multiple parallel wired networks for telephony in the same geography. Calling people on other networks was difficult if not impossible—network operators would often intentionally make interconnection problematic. Each network tried to dominate its own territory and the entire industry was a …

More in Chaos

Chaos

Netanyahu and Trump’s war on Iran leaves India counting the costs

India has much at stake in West Asia. It must step up and act like the leader of the Global South that it aspires to be.

You may also like

Business

Reliance’s growth engines may be losing steam

Telecom and retail, which account for half the conglomerate’s revenue and most of its valuation, aren’t accelerating fast enough to justify their price tags.

Internet

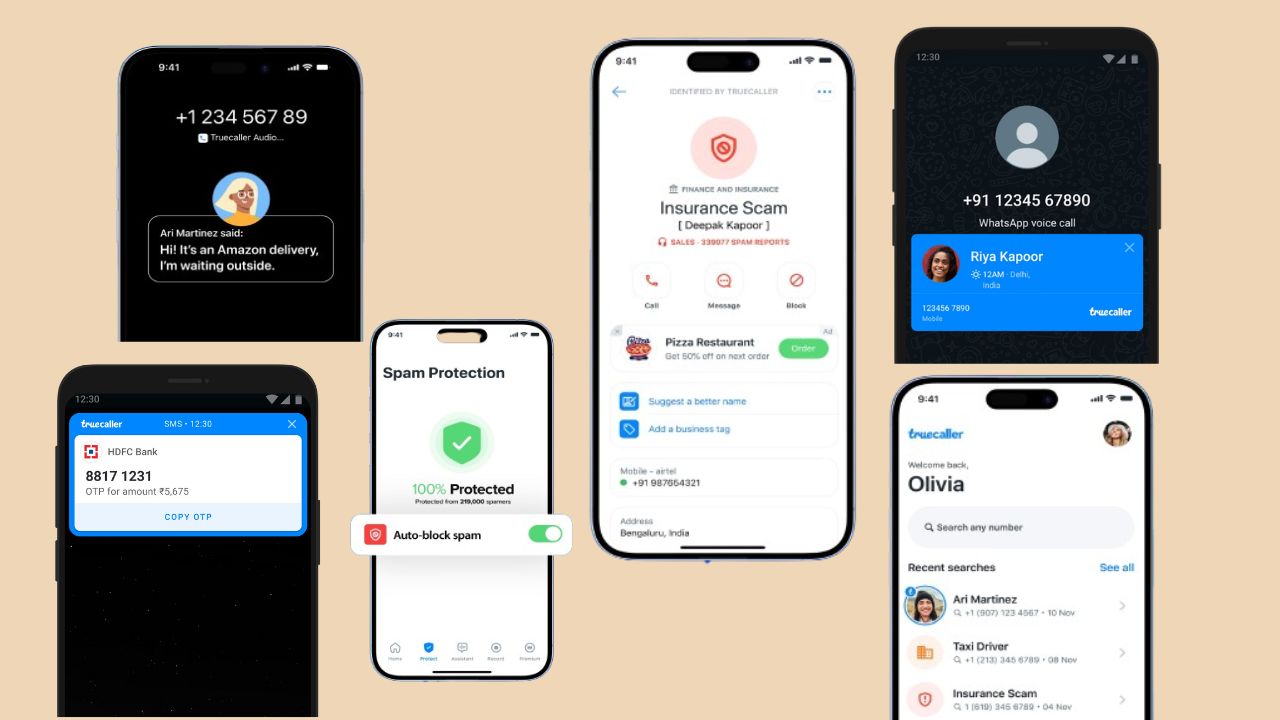

India made Truecaller a tech behemoth. Now it is slowly stifling the company

For over a decade, the Swedish caller ID company thrived on India’s lightly regulated digital ecosystem. Now, it faces some existential questions in its largest market.

Business

Conglomerates, duopolies and domination hamper India

The domination of a few business groups—conglomerates—is a defining feature of the country’s economy. This has been enabled by policy, leading to stifled innovation and hindered progress. All of this, in turn, exacerbates inequalities.