Singapore is pissed + Twitter India’s new appointment

India’s ban on Free Fire triggers a diplomatic row; the social networking firm may have finally found the right public policy chief.

25 February, 2022•9 min

0

25 February, 2022•9 min

0

Getting your Trinity Audio player ready...

Why read this story?

Editor's note: Harveen here. It seems that the Indian government may have to explain a knee-jerk regulatory decision it took earlier this month. On 14 February, the ministry of electronics and information technology (MeitY), citing security concerns, banned 54 apps it believed to be of Chinese origin. And the most popular (and strangest) candidate in this list was the gaming app Garena Free Fire. A little background here. Garena Free Fire is one of the most popular games across the world, owned by the Singapore-based and New York-listed consumer internet company Sea Ltd. Sea was founded in 2009 by Singaporean billionaires Forrest Li, Gang Ye and David Chen. All three were born in China and left the country at different (and early) stages of their lives. (This profile by Bloomberg on how Singapore nurtured the trio into becoming billionaires is a good read.) Now as the Indian ban on Garena Free Fire got announced this month, troubles started for Sea. Its stock tanked and erased $16 billion in market value in a single day. Investors panicked about the company’s future, given the …

More in Internet

Internet

Beyond The MBA: Skills That Win Placements & Build Careers

Placement season is intense. But what makes a difference are the skills underlying your resume, which help both in landing a job and growing beyond it.

You may also like

Internet

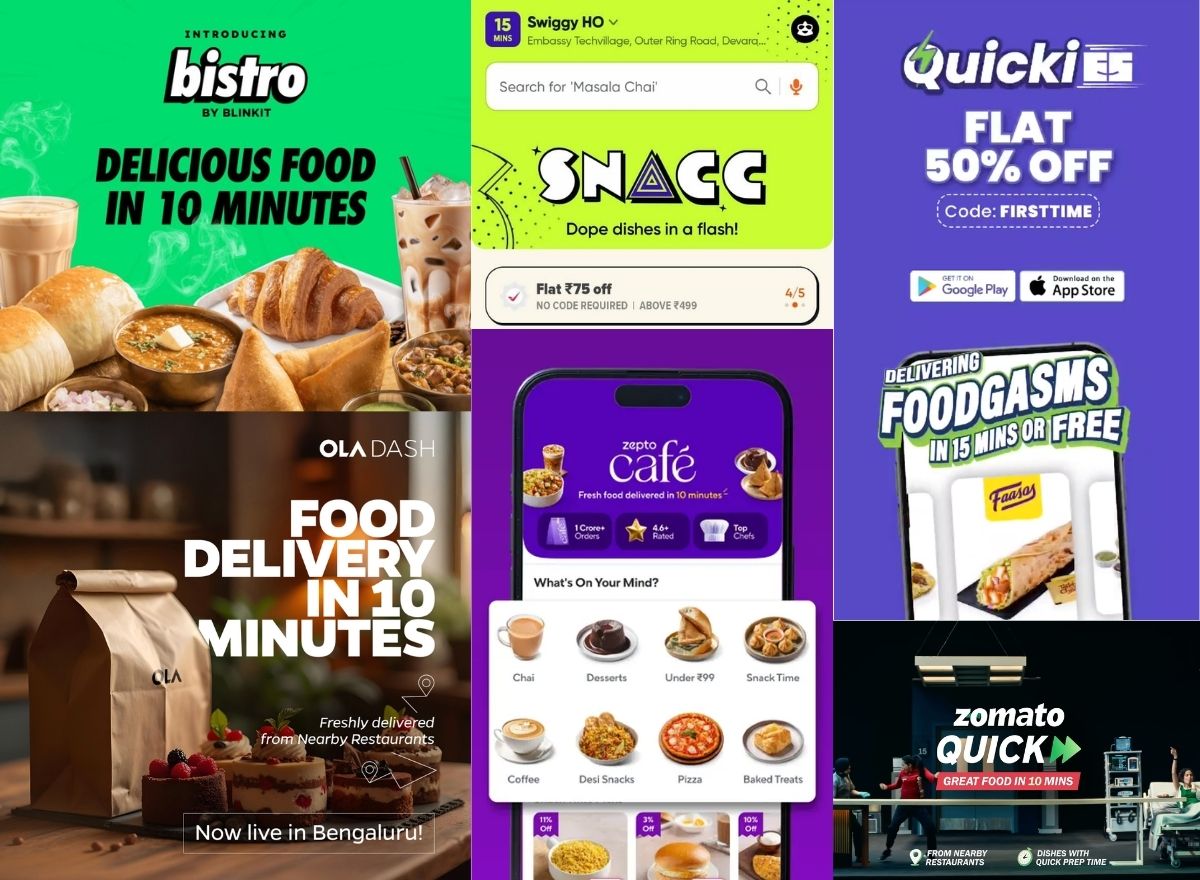

Why Swiggy, Zomato, Zepto can’t deliver food in 10 minutes

With Swiggy joining the list of companies shutting down their ultra-fast food delivery services, we look at what’s plaguing the 10-minute food delivery sector. And whether there’s any hope at all for those trying.

Internet

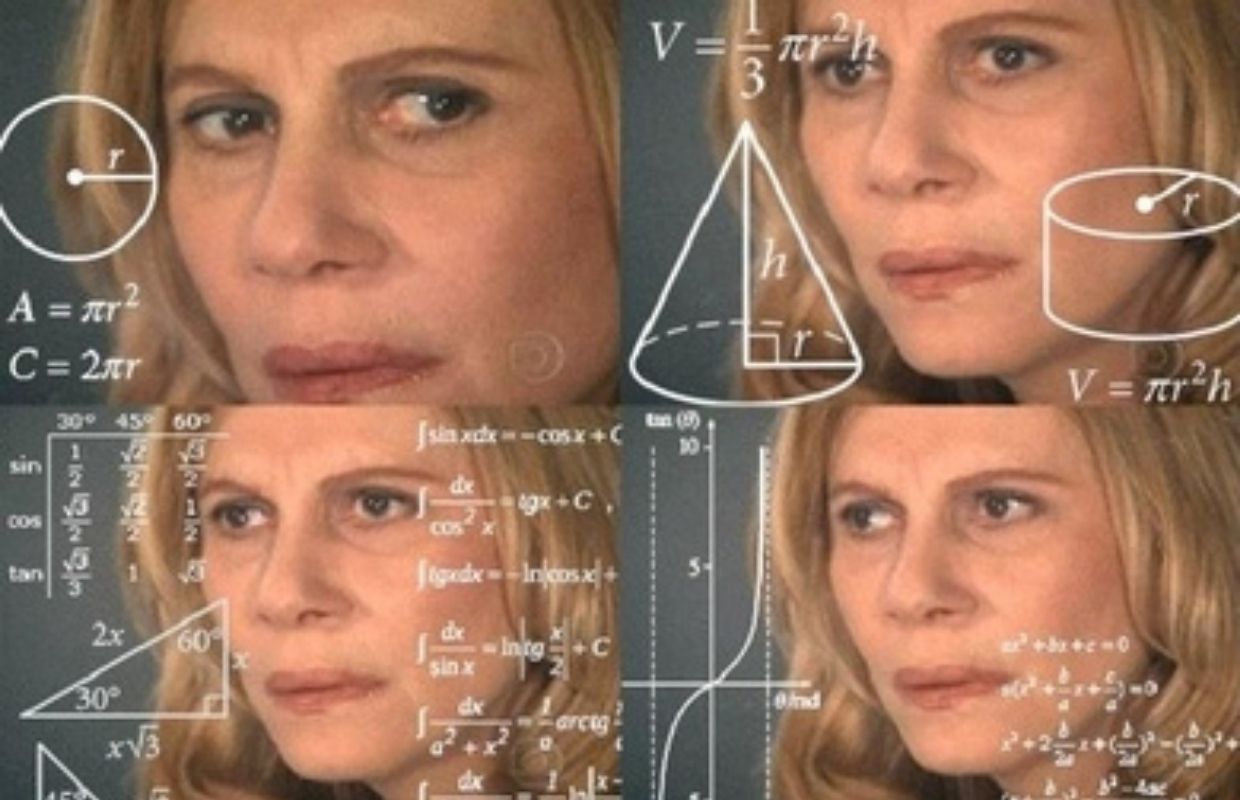

Inside the math of instant help startups

Millions of VC dollars are being splurged to service the last-minute needs of Indians—little revenue, increasing cash burn and far too many variables. At what point does it all come together?

Chaos

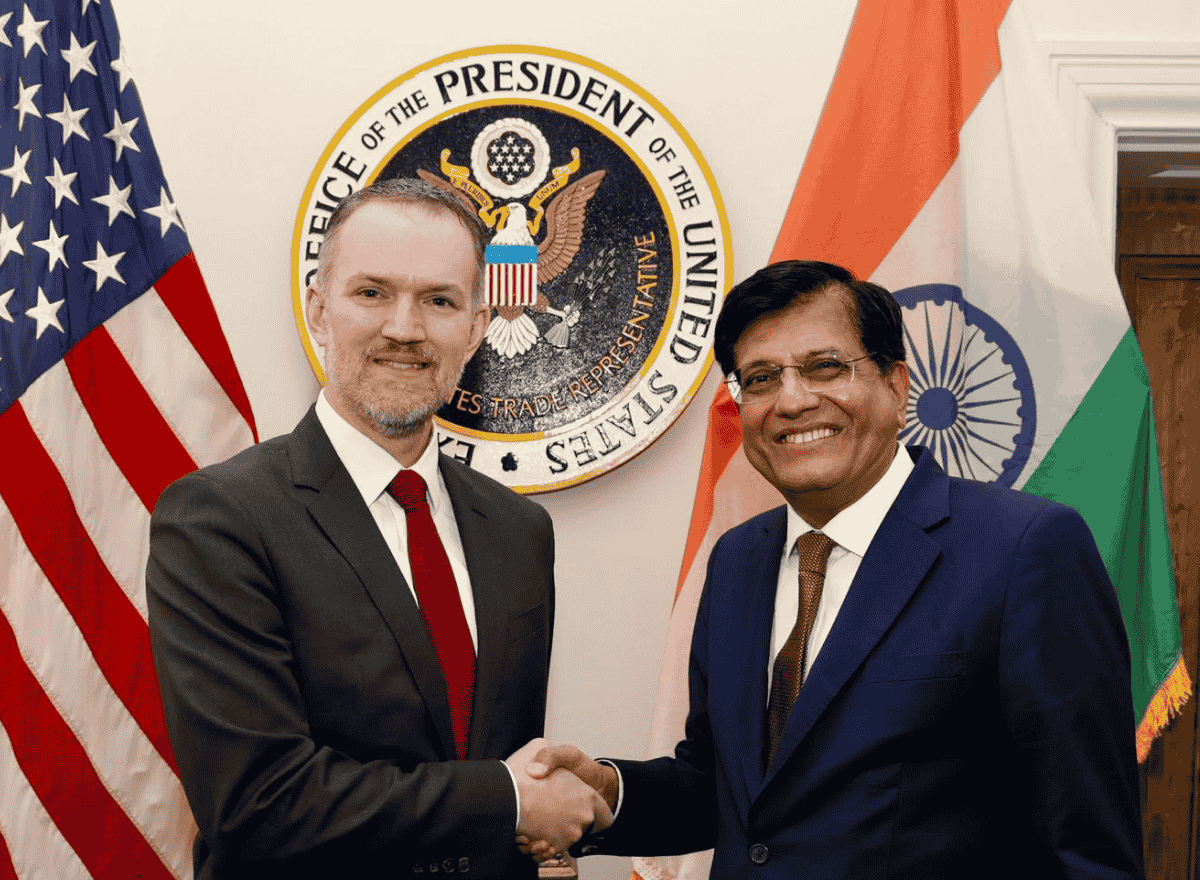

India-US trade pact demonstrates how sovereignty is eroded in practice

The framework reads less like an agreement between partners and more like a probation order written by the stronger side.