Why does UPI fail so often for banks like SBI?

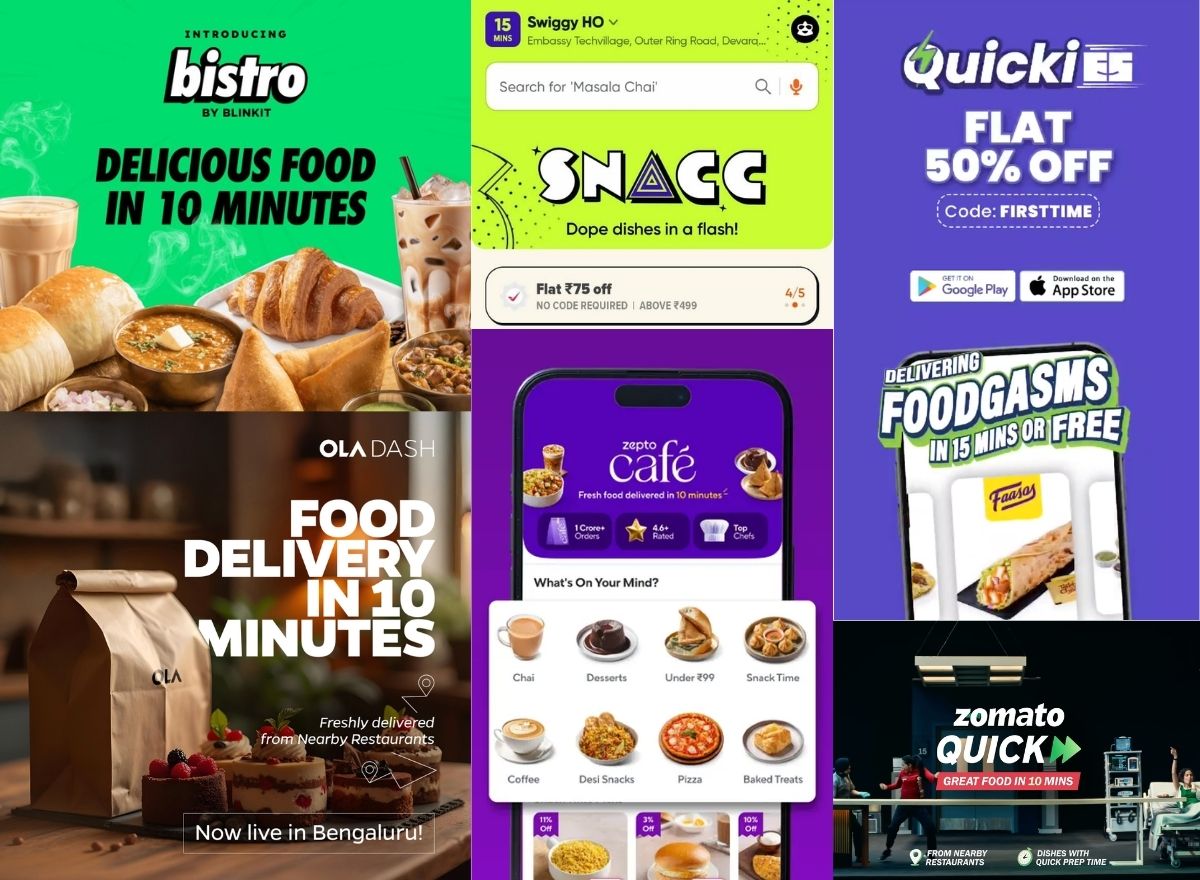

While transaction failures continue to rise, some lenders are reluctant to upgrade their outdated digital infrastructure given the lack of incentives.

9 August, 2022•6 min

0

9 August, 2022•6 min

0

Getting your Trinity Audio player ready...

Why read this story?

Editor's note: There is a brief moment of anxiety that everyone who makes payments using the Unified Payments Interface is accustomed to by now. It occurs as soon as you enter your PIN on a UPI-enabled app. What follows is the wait for the transaction to be approved—by the customer’s bank, the merchant’s bank, the app and the merchant’s payment partner. Finally, the pop-up on your phone notifying that the payment has been successful brings relief. No matter which bank or payment app we use, most of us have seen our UPI transactions fall through while money is still debited from our bank accounts. I recently got into an argument with the manager at a restaurant in New Delhi’s Connaught Place after they refused to accept the payment I made using a UPI app. This was despite the notifications I received for successful transaction from both the app and the bank. The restaurant, on the other hand, claimed that they had not received a notification from their bank about a fund transfer. The manager insisted it was the restaurant’s policy to turn …

More in Internet

Internet

Beyond The MBA: Skills That Win Placements & Build Careers

Placement season is intense. But what makes a difference are the skills underlying your resume, which help both in landing a job and growing beyond it.

You may also like

Internet

Is a company’s profit fact or narrative?

Profit or loss is a definitive number because it can be traced back to a company’s books of accounts, audited by a certified auditor. Any number that doesn’t have this stamp of sanctity is a baseless claim.

Business

SBI Mutual Fund gains at the cost of its parent

India’s largest lender is going out of its way to grow its mutual fund business at the cost of shareholders, raising questions of corporate governance.

Internet

Who should solve the UPI Autopay menace?

The feature has attracted a whole host of startups taking people for a ride. The problem is now large enough for an efficient regulator to step in.