Inside the rot at Axis Mutual Fund

Customers are pulling out thousands of crores even as the asset management company investigates its fund managers for front-running trades.

9 May, 2022•13 min

0

9 May, 2022•13 min

0

Getting your Trinity Audio player ready...

Why read this story?

Editor's note: For the lay investor, Axis Mutual Fund was a safe, reliable, credible and consistent fund house to invest in. That faith has now been shattered as the asset management company has sent two of its top fund managers on forced leave over allegations of front-running trades. Just last Wednesday, Axis Mutual Fund was conferred with the title of “best fund house” across equity and debt investment schemes by market research firm MorningStar India. But by Friday, its reputation had been fractured. The fund announced a change in its equity team leadership as it suspended chief trader and fund manager Viresh Joshi and assistant fund manager Deepak Agarwal over allegations that they pocketed crores of rupees by front-running trades. Axis Mutual Fund, a joint venture between Axis Bank and UK-based asset manager Schroders, is the seventh-largest mutual fund company in the country, with Rs 2.59 lakh crore of assets under management. “The initial investigation has revealed that the ill-gotten gains from front-running would stand at about Rs 200 crore,” says an executive at Axis Mutual Fund, asking not to be named. …

More in Business

Business

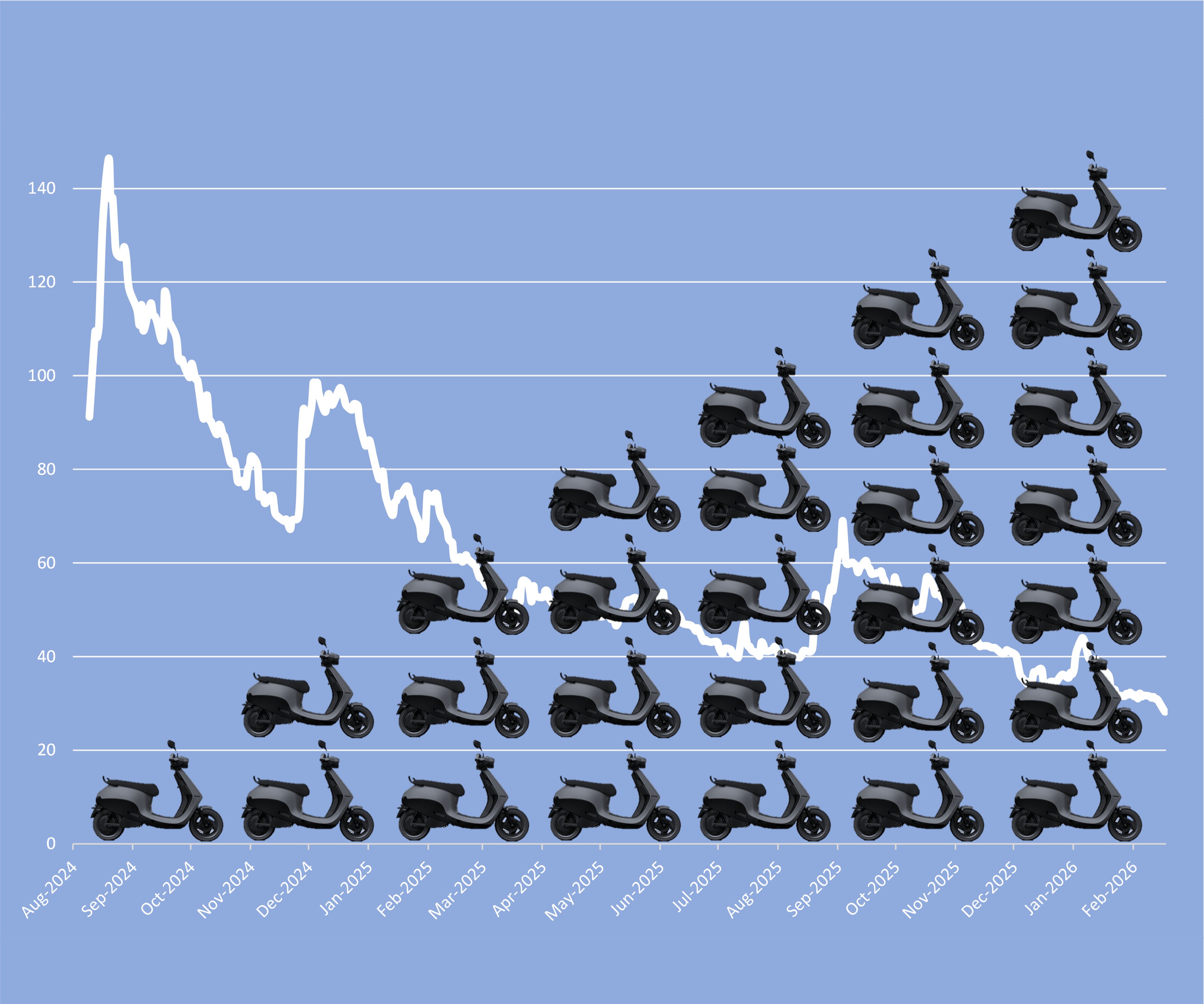

Motilal Oswal Mutual Fund’s inexplicable Ola Electric love

While its peers headed for the exit, the fund house doubled down on the falling stock. The contrarian call now looks expensive—and risky.

You may also like

Business

Amitabh Chaudhry needs to rethink Axis Mutual Fund’s revival strategy

The fund house has fallen behind its peers. What explains the sub-par performance?

Internet

Can SEBI get a good social media team for investor education?

With social media becoming a crucial source of financial guidance, it doesn’t help that many first-time investors remain strikingly unaware of regulations meant to protect them against unregistered entities.

Business

Mumbai's worsening garbage crisis, and the company in the thick of it

The Kanjurmarg landfill, operated by Antony Waste Handling Cell Ltd., is safe from the axe for now. But its fate remains a major source of worry for the company's shareholders and the city's residents alike.