Is Waaree India’s most promising renewable energy stock?

The country’s largest solar module maker has seen an 86x jump in its stock price in three years and, by the looks of it, has more in the tank to keep going at this pace.

2 May, 2023•9 min

0

2 May, 2023•9 min

0

Getting your Trinity Audio player ready...

Why read this story?

Editor's note: There’s just no slowing down Waaree Energies. India’s largest maker of solar modules, with a manufacturing capacity that just hit 12 gigawatts, is already larger than rivals Adani Solar and Vikram Solar put together. It is also amongst the largest beneficiaries of the latest tranche of the government’s production-linked incentive, or PLI, scheme for manufacturing solar equipment, bagging 6 GW worth of the total 39.6 GW awarded. The stock of its listed subsidiary, Waaree Renewable Technologies, has gone up over 8,600% in the last three years, making it among the best-performing energy stocks. The share has seen a rise of over 167% in just a year. In fact, such has been its momentum that even Waaree Energies’s failed IPO did little to dampen investors’ interest. Between September 2021 (when the parent filed its draft papers with SEBI) and October 2022 (when it announced a private fundraise and postponement of the IPO), the stock rose nearly 200%. After the IPO was shelved, the shares have continued their upward trajectory, up over 80% between October and close of trading on Monday. So, …

More in Business

Business

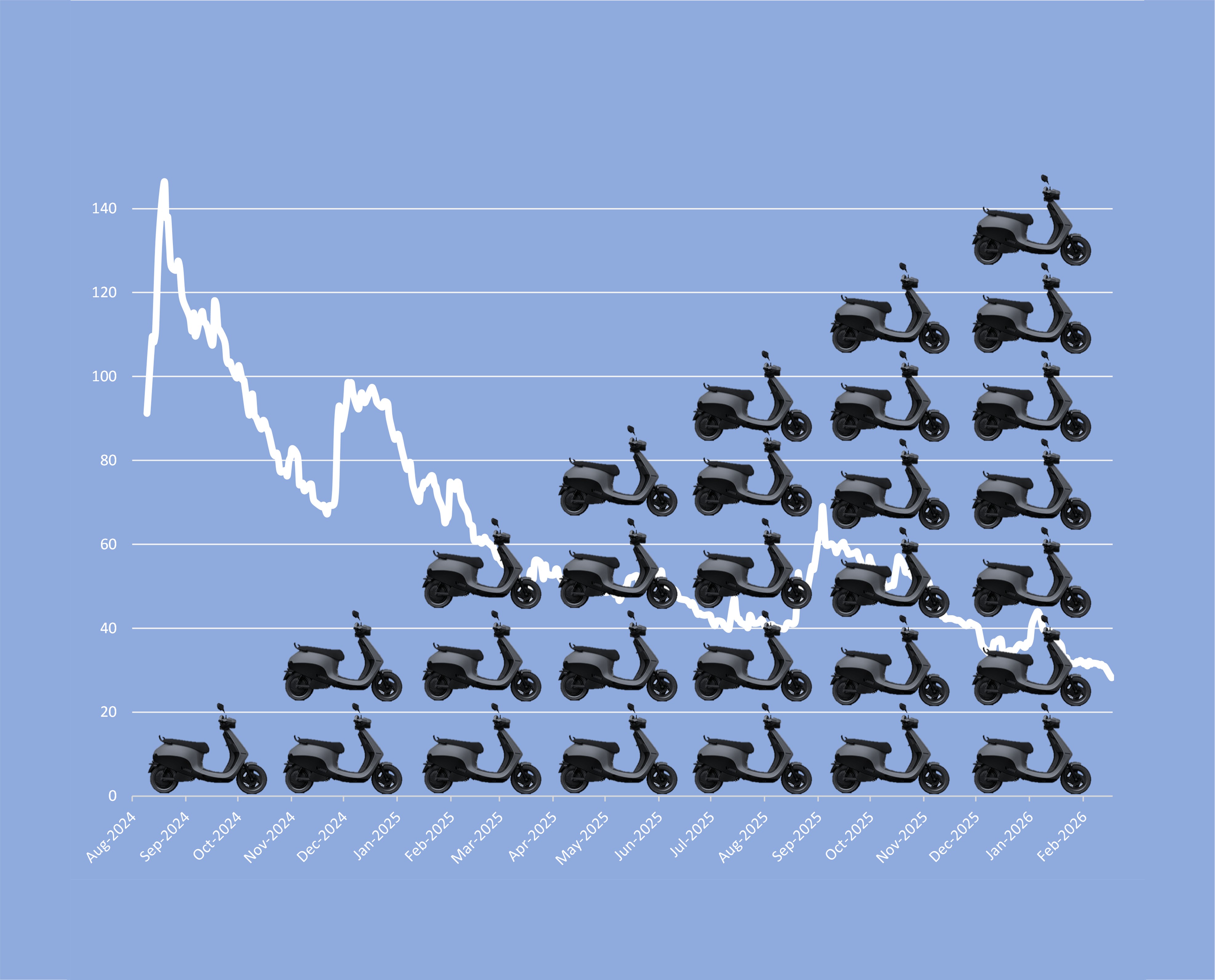

Motilal Oswal Mutual Fund’s inexplicable Ola Electric love

While its peers headed for the exit, the fund house doubled down on the falling stock. The contrarian call now looks expensive—and risky.

You may also like

Business

Growth alone isn’t enough, Waaree needs to do more

The solar module maker’s investors want proof of its durability in the face of a leadership change and a costly push into energy storage.

Business

Has IndiGrid cracked the green finance code?

Blending capital from investors with varying risk appetite to fund green projects has emerged as a reliable model for the KKR-backed InvIT—its latest for India's largest battery energy storage project being an example.

Business

Waaree caught in a global solar patent crossfire

A lawsuit in the US threatens to eclipse a significant chunk of the overseas business done by India's biggest solar panel manufacturer, putting its investors at grave risk.