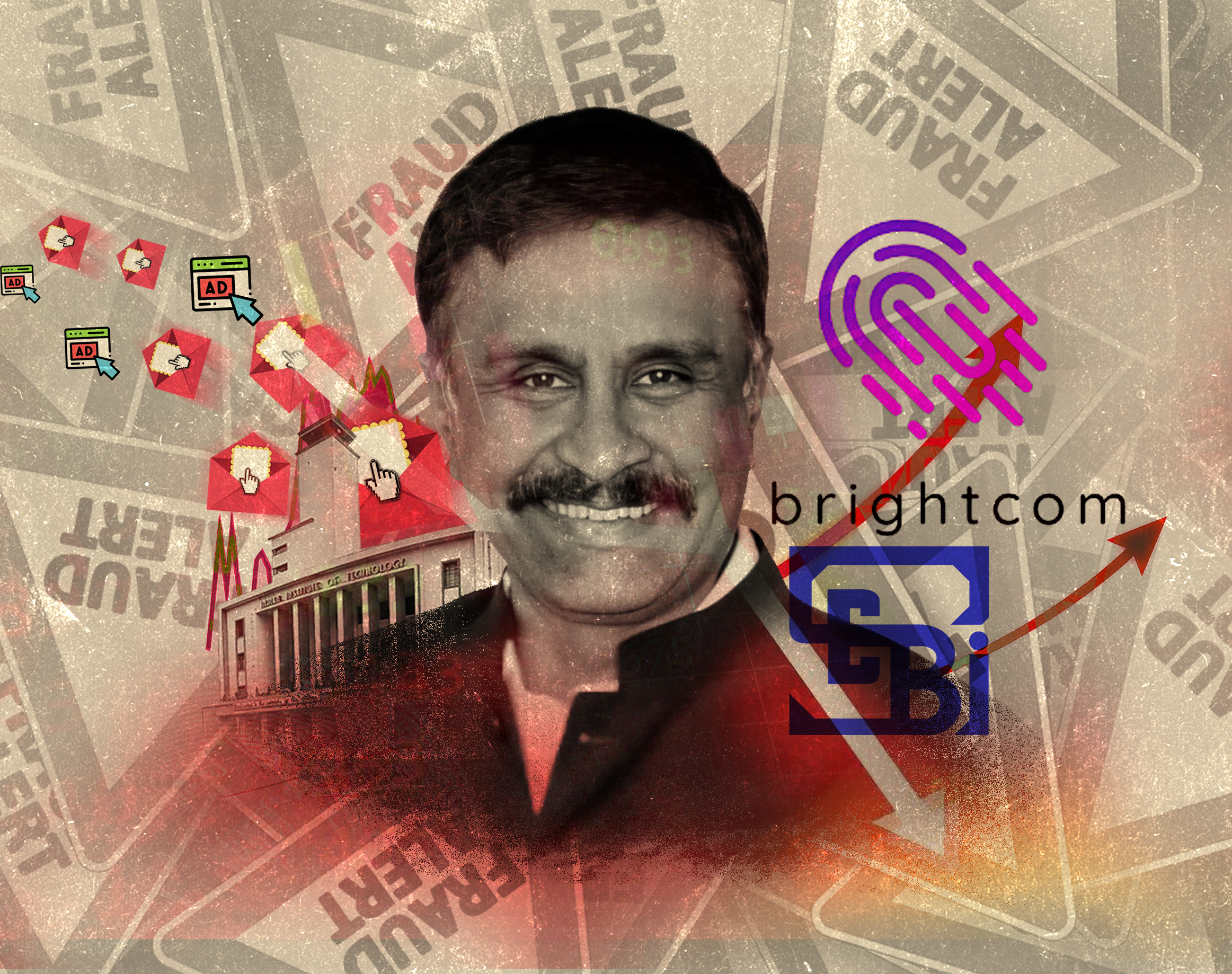

SEBI still has milk teeth, shows Brightcom

Hyderabad-based company leaves out crucial details on promoter holding with zero consequences so far

28 April, 2022•9 min

0

28 April, 2022•9 min

0

Getting your Trinity Audio player ready...

Why read this story?

Editor's note: The tale of Brightcom, its promoters and India's capital markets regulator is a story in three acts. One that reflects poorly on all involved. Act I What would you expect when a promoter group sells 90% of its stock in a company that has seen its share price rise very quickly and is currently under investigation by the securities regulator? At the very least there would be an exodus of investors and the company's shares would tank. Right? Well, the shares of Hyderabad-based digital marketing solutions company Brightcom Group, which is under a forensic audit by the Securities and Exchange Board of India, actually ended up rising. What’s your guess? That investors couldn’t get enough of Brightcom's exemplary growth story, which has already seen the stock move up from less than Rs 10 to Rs 145 in under a year? The answer is simpler. Information about Brightcom’s promoters’ stake sale never made it to websites of the stock exchanges, even though it is a mandatory disclosure for companies. The regulator’s rules explicitly state that if promoters sell their stake or …

More in Business

Business

Ajay Singh’s SpiceJet turnaround story is running on fumes

As much as he would like to convince investors about the airline’s prospects, it’s increasingly clear the low-cost carrier is just about managing to stay afloat.

You may also like

Business

SEBI’s overdue expansion is underway, but top-level gaps persist

India’s market regulator is looking to ramp up hiring at the entry level. But what really needs attention is the constant uncertainty at the top and the lack of domain experts.

Business

Ten business developments for 2026

Who’s going to lead the IPO party, what’s going to drive the market, where are some of the leading businesses headed, and more.

Internet

Can SEBI get a good social media team for investor education?

With social media becoming a crucial source of financial guidance, it doesn’t help that many first-time investors remain strikingly unaware of regulations meant to protect them against unregistered entities.