BillDesk founders have to slog again towards a distant IPO

A public listing could be the payment firm’s only option of bouncing back from the failed buyout in a challenging market.

23 November, 2022•10 min

0

23 November, 2022•10 min

0

Getting your Trinity Audio player ready...

Why read this story?

Editor's note: After the Prosus deal fell through last month, BillDesk is weighing an initial public offering, according to three industry executives aware of the matter. While an IPO is unlikely before 2024, a challenging funding environment, coupled with the founders’ aspirations to eventually step down from BillDesk’s day-to-day operations, makes a stock exchange listing the most likely next step as the 22-year-old payment gateway looks to put a failed buyout behind it, they said, on condition of anonymity. On 3 October, the Amsterdam-based investment group called off a $4.7 billion deal to acquire BillDesk and merge it with its payments arm, PayU, citing unmet conditions before the time frame agreed upon to consummate the agreement. The BillDesk founders—M.N. Srinivasu, Ajay Kaushal and Karthik Ganapathy—had earlier decided to step down within 12 to 18 months of the merger, said the executives cited above. They were planning to pursue independent interests in social impact and angel investing by setting up family offices and mentoring, said two of the three executives. The trio, who together own 30% of the firm, would have pocketed around …

More in Internet

Internet

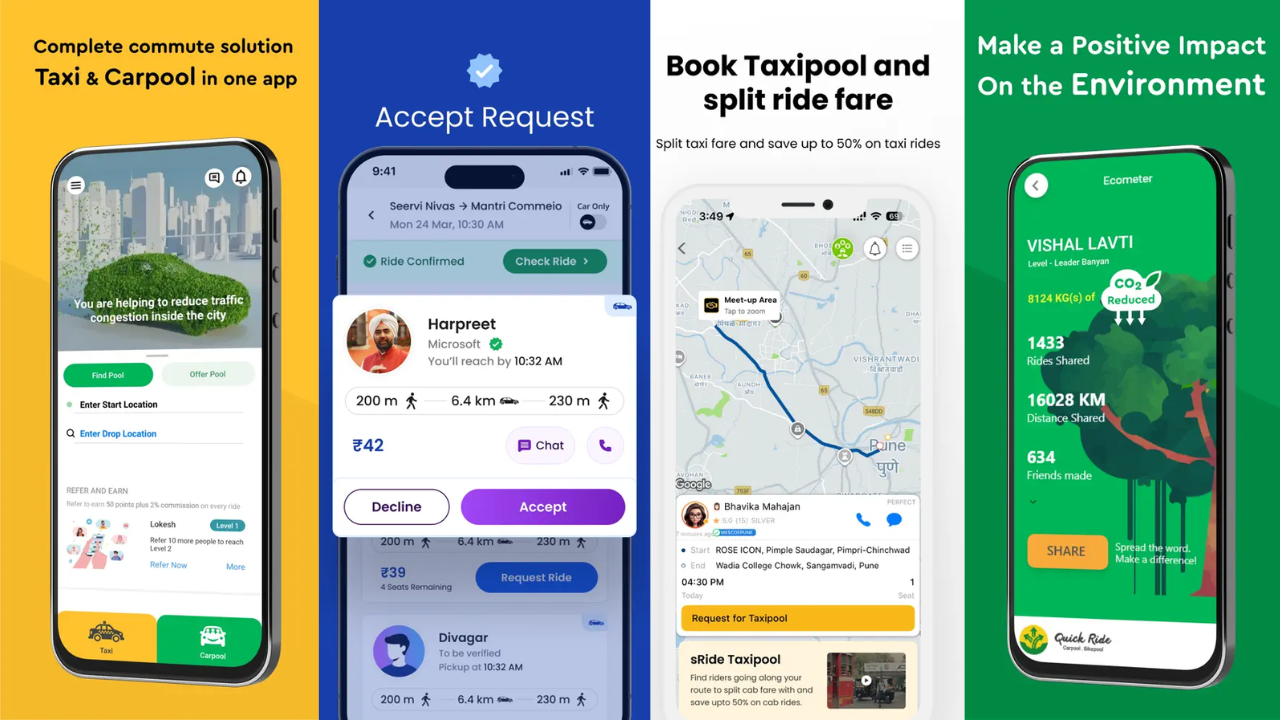

How India’s carpooling experiment ran out of road

Shared rides seemed tailor-made for India’s congested cities. Yet, economics, trust and regulation kept the idea from scaling.

You may also like

Business

CSB Bank’s deposits are a ticking time bomb

The Kerala-based bank has been chasing costly and risky bulk term deposits amid tanking profitability.

Business

Yes Bank’s succession problem is a board problem

As Prashant Kumar’s term runs out, boardroom fault lines have left the lender with no clarity on its next CEO—spooking investors and drawing the RBI’s ire.

Internet

Why SoftBank has shunned India

For one of the world’s largest and shrewdest investors to entirely skip putting money in the country is a sign of how quickly the nature of the Indian startup ecosystem has changed.