India’s startup growth story lacks fundamentals - Part 1

Indian tech startups and consumer internet companies have—or will—hit a wall. We look at why, sector by sector.

9 March, 2023•9 min

0

9 March, 2023•9 min

0

Getting your Trinity Audio player ready...

Why read this story?

Editor's note: When Indian startups raised a record amount of funds in 2019, followed by the minting of a dozen unicorns in 2020, many counted dollars raised as a marker for the tech upstarts to take over the market. The COVID-19 pandemic followed soon after, which served as a validation of eye-watering valuations for many consumer internet companies. Nothing could go wrong. But, it did. The US Federal Reserve has raised interest rates seven times since 2022 and continues to be hawkish to control inflation. That put a hold on much of the money supply allocated to emerging markets like India. As the investment environment became constrained, investors started dusting business evaluation and diligence questions that have been kept in storage for the last 10 years. Under usual circumstances, a constrained funding environment should not be a dealbreaker for small and large companies involved in the Indian internet economy. However, they should demonstrate mastery of two out of three business fundamentals: Growth—an increase in consumers and revenueA path to profitability—reduced customer acquisition and operating costsSignificant barriers to entry (a.k.a. a moat) We …

More in Internet

Internet

Beyond The MBA: Skills That Win Placements & Build Careers

Placement season is intense. But what makes a difference are the skills underlying your resume, which help both in landing a job and growing beyond it.

You may also like

Internet

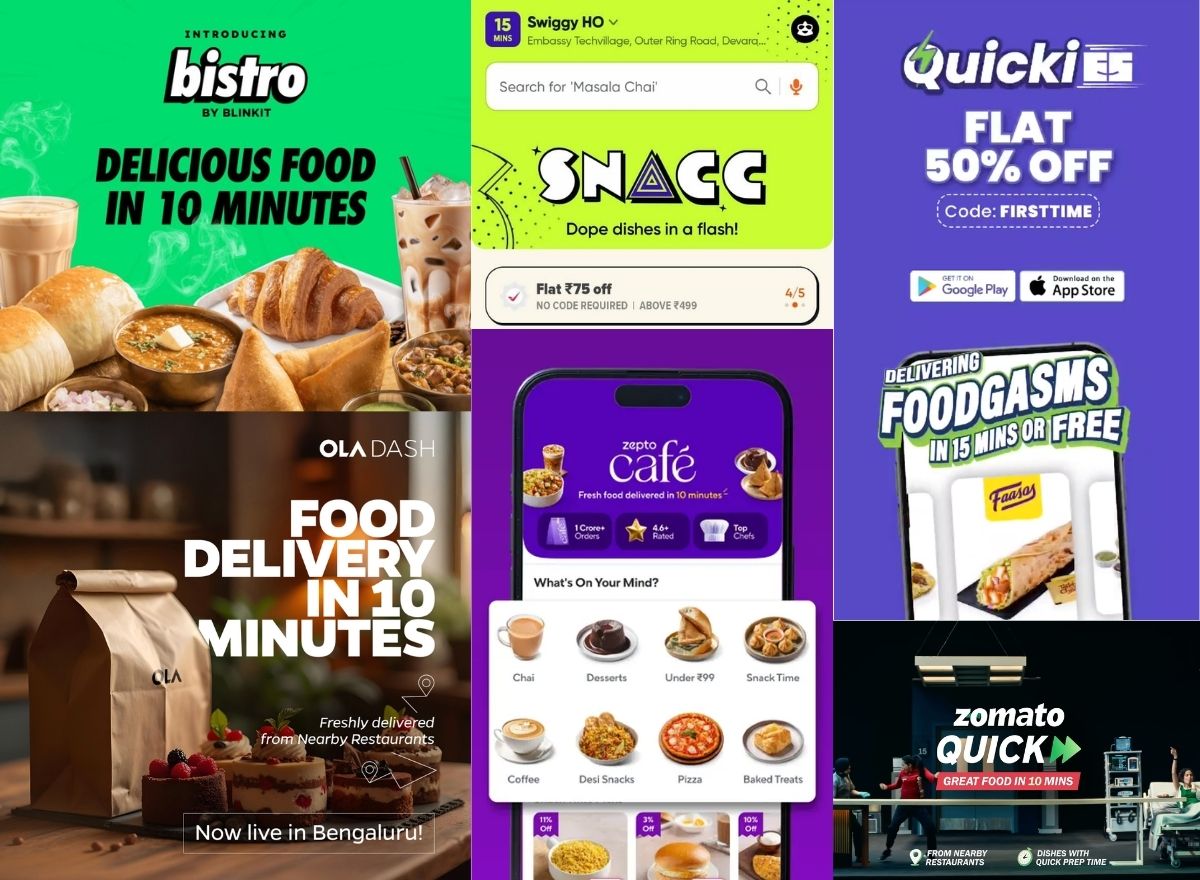

Why Swiggy, Zomato, Zepto can’t deliver food in 10 minutes

With Swiggy joining the list of companies shutting down their ultra-fast food delivery services, we look at what’s plaguing the 10-minute food delivery sector. And whether there’s any hope at all for those trying.

Internet

FirstCry’s Mideast conundrum

The Indian mother and baby products retailer has been slow to grow in the two largest markets of the Gulf. What gives?

Internet

Inside the math of instant help startups

Millions of VC dollars are being splurged to service the last-minute needs of Indians—little revenue, increasing cash burn and far too many variables. At what point does it all come together?