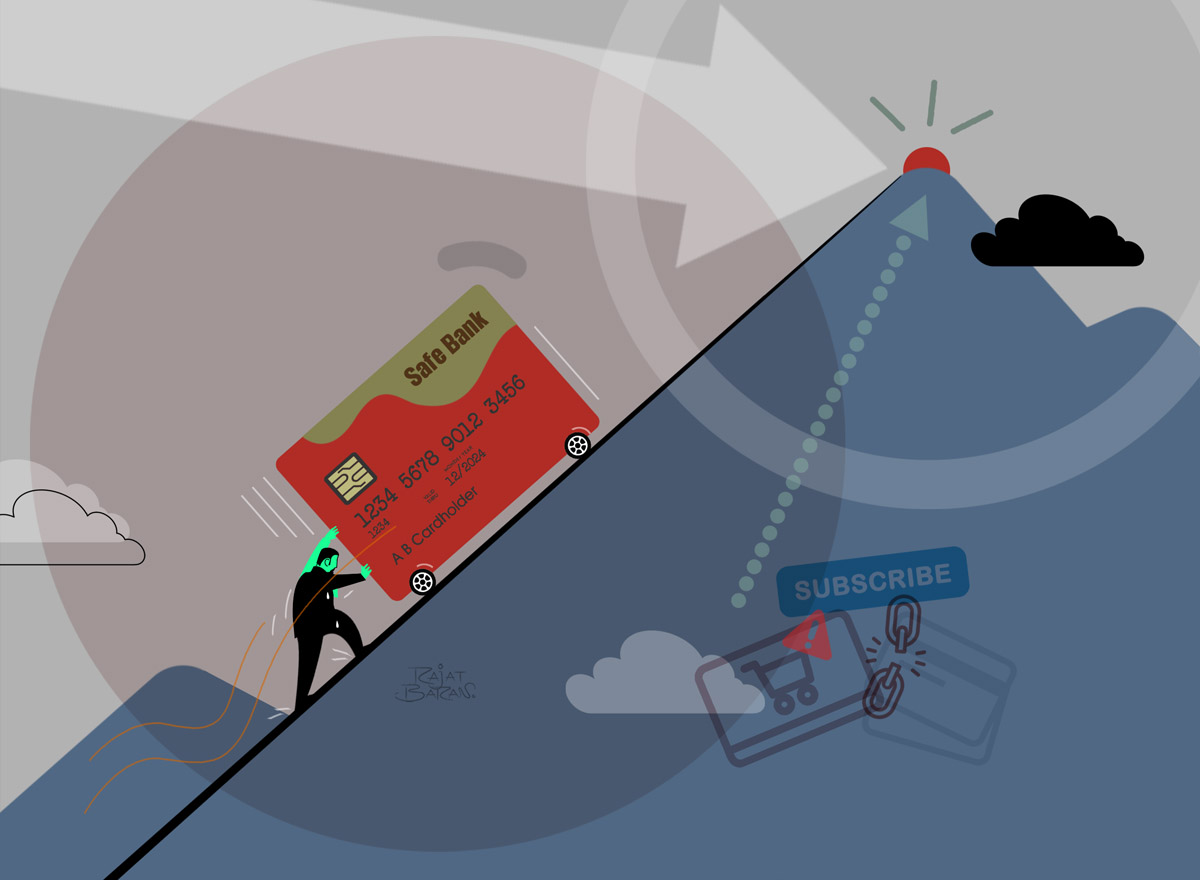

Recurring card payments are going to fail again

The RBI isn’t budging on its deadline for card tokenization, three weeks away now—and auto-debits on card tokens aren’t ready yet.

12 September, 2022•12 min

0

12 September, 2022•12 min

0

Getting your Trinity Audio player ready...

Why read this story?

Editor's note: Siddharth Sridharan is the chief executive of Spendflo, a startup that helps companies buy and manage their software subscriptions. His work has been cut out for him by the Reserve Bank of India for the second time in the last 12 months. “Our clients have lost access to their cloud services, email and other enterprise software they are dependent on. These are not small payments, they run into lakhs and crores every month. While mid to large companies are able to use Singapore or US bank accounts to continue paying for their software services, smaller businesses using Indian cards are suffering,” says Sridharan. “In terms of our business, I had to move all our payments to my US bank account and card last year. Overall, our collection time frame and administrative overheads have significantly increased,” he says. Spendflo was just one business affected by the havoc around the RBI’s recurring payment rules, which came into effect in September 2021. Banks and the payments industry had largely dragged their feet on the new regulations—which required revamping systems to give customers control …

More in Internet

Internet

Beyond The MBA: Skills That Win Placements & Build Careers

Placement season is intense. But what makes a difference are the skills underlying your resume, which help both in landing a job and growing beyond it.

You may also like

Business

The Rs 590-crore blame game at IDFC First Bank

Divergent narratives from the Haryana government and the lender raise deeper questions on oversight, authorizations and systemic lapses—answers that may emerge only after a forensic audit.

Business

Exclusive: Jana Small Finance Bank to reapply for universal bank licence in May

The Bengaluru-based lender is once again gearing up to seek the RBI’s nod after the central bank returned its application last year.

Business

CSB Bank’s deposits are a ticking time bomb

The Kerala-based bank has been chasing costly and risky bulk term deposits amid tanking profitability.