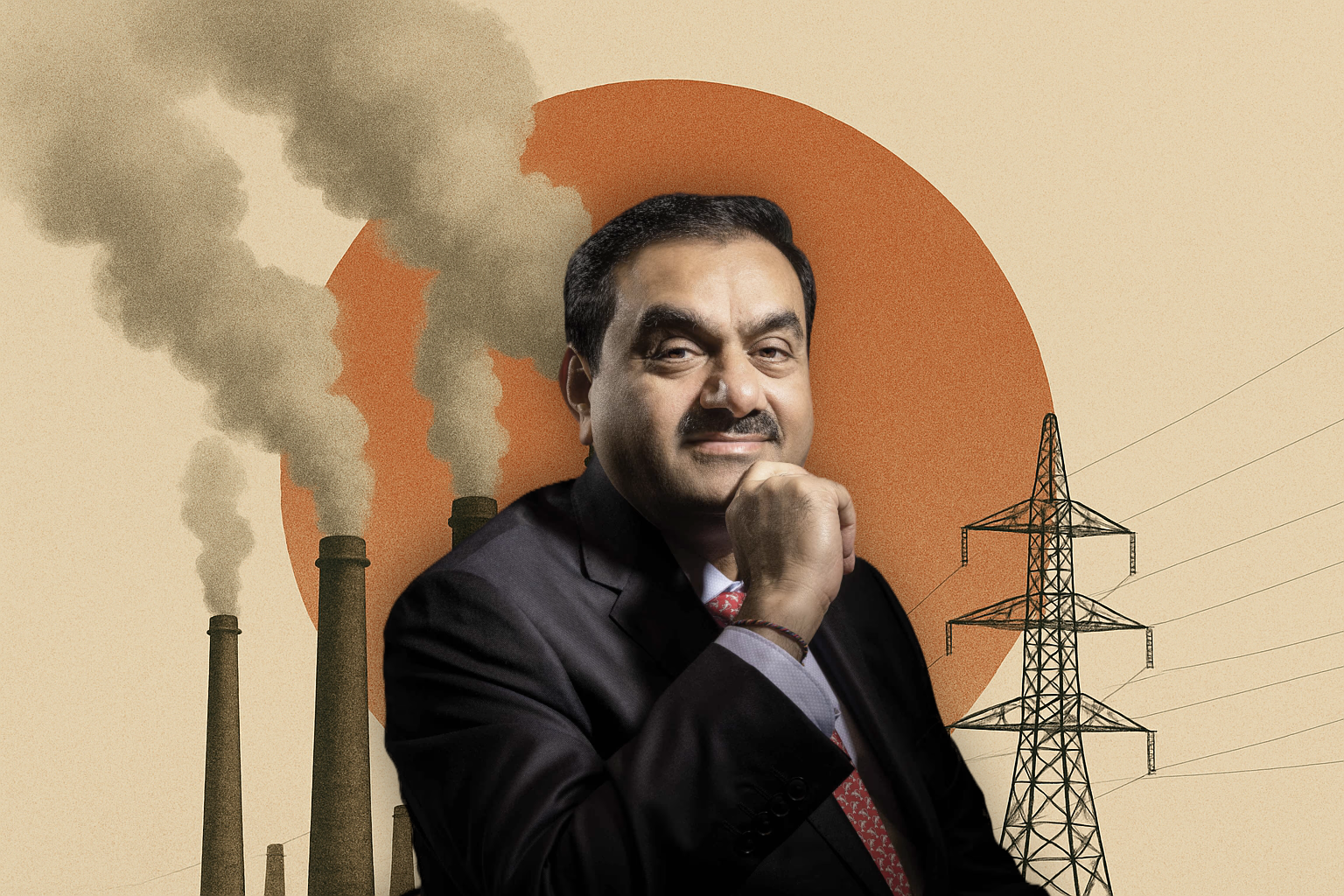

A spooked LIC, shares in free fall forced Gautam Adani’s hand

After withdrawing the Rs 20,000 crore FPO, his coal-to-ports conglomerate now faces a funding crisis.

3 February, 2023•12 min

0

3 February, 2023•12 min

0

Getting your Trinity Audio player ready...

Why read this story?

Editor's note: India’s largest follow-on public offer to raise Rs 20,000 crore (about $2.4 billion) was cancelled on Wednesday evening, a day after Adani Enterprises managed to close the offer successfully, with global funds and family offices pitching in with generous investments. The Adani group flagship said it would return investors their money. Chairman Gautam Adani cited the “current market volatility” for the sudden decision, and insisted it was taken to protect investors. “Given these extraordinary circumstances, the Company’s board felt that going ahead with the issue would not be morally correct. The interest of the investors is paramount and hence to insulate them from any potential financial losses, the Board has decided not to go ahead with the FPO,” he said in a message to stock exchanges. But the fact is that had the FPO gone through at a time when Adani Enterprises's shares were in free fall, the investors would have faced losses as soon as they got their shares. And, with no sign of a recovery in the stock’s price on the horizon, investors would have lost faith …

More in Business

Business

Can Adani pull off the 100% green AI promise?

The group’s $100 billion data centre push rests on solving clean energy’s toughest constraint: consistent, real-time renewable supply at scale.

You may also like

Business

Reliance’s growth engines may be losing steam

Telecom and retail, which account for half the conglomerate’s revenue and most of its valuation, aren’t accelerating fast enough to justify their price tags.

Economy

Is battery-storage in India becoming a commodity?

The Adani Group’s plan to build a massive storage project in Gujarat signals a mature technology and a sector moving towards scale and consolidation.

Business

Why Adani Power is betting billions to dominate coal’s twilight years

India’s largest private thermal power producer is taking a contrarian call to scale up in the face of weakening coal economics. The way power agreements are structured has a lot to do with it.