Little ado about Snapdeal

The e-commerce company’s draft IPO papers avoid addressing the competition and paint an unflattering picture on growth and costs.

10 January, 2022•13 min

0

10 January, 2022•13 min

0

Getting your Trinity Audio player ready...

Why read this story?

Editor's note: Snapdeal is a cautionary tale. Once a formidable No. 2 in the early years of Indian e-commerce, through a series of leadership missteps, costly acquisitions, multiple priorities, investor misalignment and hubris, is now reduced to an also-ran, searching for relevance in a thin slice of retail e-commerce that has been left by Amazon and Walmart-Flipkart. Now, six years after Snapdeal hit a peak valuation of $6.5 billion, it is approaching the public markets at a steep discount. We will not get into the how and why of Snapdeal’s fall from grace. (Read “The bittersweet relevance of Snapdeal 2.0” for more.) Instead, we’re reviewing Snapdeal’s draft IPO prospectus dated 20 December 2021, to see if there is any story that is left to sell. Value in e-commerce The most interesting part and the entire hypothesis of valuing the company is in “Section IV: About our Company - Industry Overview” of Snapdeal’s draft red herring prospectus. It is prefaced with the following remarks: The information contained in this section, unless otherwise specified, is derived from the report titled “Value Retail & eCommerce …

More in Internet

Internet

Inside the math of instant help startups

Millions of VC dollars are being splurged to service the last-minute needs of Indians—little revenue, increasing cash burn and far too many variables. At what point does it all come together?

You may also like

Internet

Can Temu gain ground in the UAE?

The relatively new online marketplace seems to be doubling on its UAE momentum. We take a look at what is at stake.

Internet

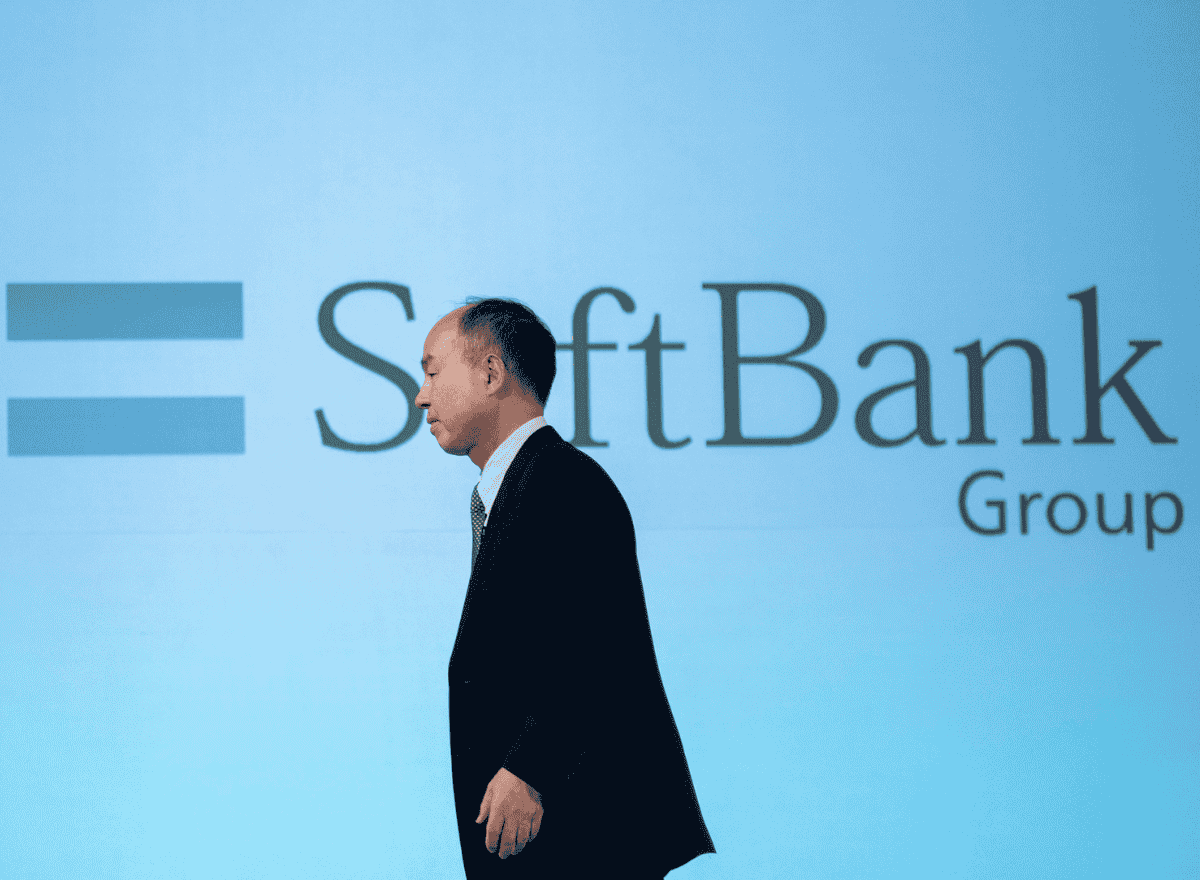

Why SoftBank has shunned India

For one of the world’s largest and shrewdest investors to entirely skip putting money in the country is a sign of how quickly the nature of the Indian startup ecosystem has changed.

Business

Ten business developments for 2026

Who’s going to lead the IPO party, what’s going to drive the market, where are some of the leading businesses headed, and more.