Oversize #10: Airtel’s realization: diversify or die

5 October, 2020•7 min

0

5 October, 2020•7 min

0

Why read this story?

Editor's note: In 2013, India had about a dozen operators serving a little over 700 million subscribers. Bharti Airtel Ltd led with a quarter of the market share. In 2016 (before Reliance Jio Infocomm Ltd started services), the number of operators had reduced to eight, while the active subscribers had crossed 900 million. The Indian mobile telephony market is more consolidated now with three private operators—Airtel, Jio, and Vi (Vodafone Idea Ltd, which rebranded itself as Vi recently)—and one government operator, BSNL. We are talking a billion subscribers with Airtel and Jio controlling about a third of the market each. While Jio trampled on what could’ve been Airtel’s growth, it essentially gobbled up the erstwhile players. This consolidation has also led to market repair. A senior employee at Airtel told this writer that in 2016, the company realized that the days of pure mobile play were over. “If we continued to be a dumb pipe, we would’ve just died.” India anyway has one of the lowest ARPU (average revenue per user) in the world; in 2016, it was slightly above $2, but …

More in Internet

Internet

VC-funded startups are tempting women to join the instant house help business. Can it last?

In India’s instant house help sector, dominated by Snabbit, Pronto and Urban Company, domestic workers have nothing to lose and everything to gain. At least, for the time being.

You may also like

Business

Reliance’s growth engines may be losing steam

Telecom and retail, which account for half the conglomerate’s revenue and most of its valuation, aren’t accelerating fast enough to justify their price tags.

Business

Abu Dhabi’s $16 billion push to become a finance magnet

Highlights from Abu Dhabi Finance Week, Qatar’s new (and bolder) AI ambition and the bid for Warner Bros. Discovery.

Internet

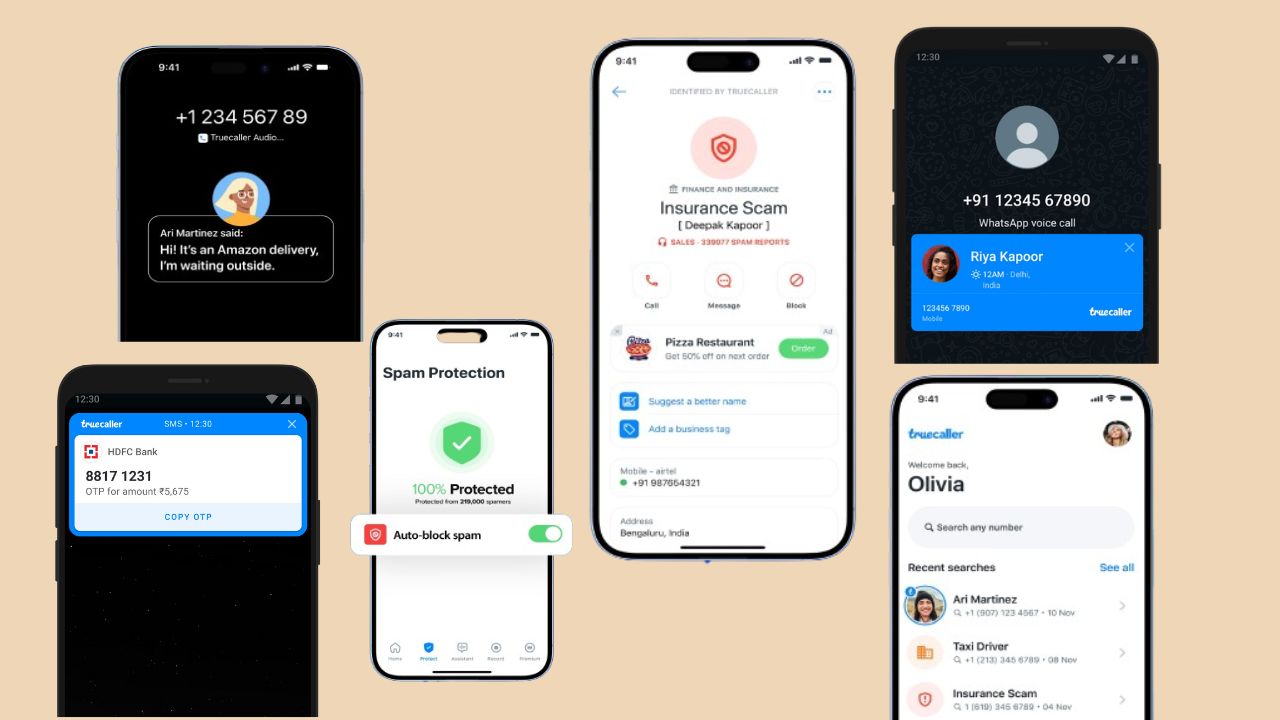

India made Truecaller a tech behemoth. Now it is slowly stifling the company

For over a decade, the Swedish caller ID company thrived on India’s lightly regulated digital ecosystem. Now, it faces some existential questions in its largest market.