Past misdeeds come back to haunt MakeMyTrip and OYO

A hefty penalty imposed by the competition watchdog and its wider implications are a cautionary tale for entrepreneurs and unicorns.

28 October, 2022•11 min

0

28 October, 2022•11 min

0

Getting your Trinity Audio player ready...

Why read this story?

Editor's note: Last week, the Competition Commission of India concluded its three-year-long investigation into the MakeMyTrip-OYO affair. In its order, the antitrust regulator asked MakeMyTrip and OYO to cough up Rs 223 crore and Rs 169 crore in penalties respectively. It is a sizeable amount, except that most CCI penalties don’t end up getting paid. The CCI has a recovery rate of about 1%, since most of its orders are challenged by aggrieved parties in higher courts, where they languish. That said, the MakeMyTrip-OYO order is important because it goes into painstaking detail about how this combine brazenly thwarted competition. At the heart of the CCI’s investigation is an examination of MakeMyTrip’s primary defence: Is the freedom of contract—the right to choose whom you do business with—fundamental? At this point, a quick recap is in order. In April 2018, when the online travel industry was in the throes of cut-throat competition, India’s largest online travel aggregator, MakeMyTrip, decided to get into bed with OYO, the up-and-coming budget room franchise and operator. MakeMyTrip and OYO weren’t exactly friends in the early years of …

More in Internet

Internet

What did India’s AI Impact gathering achieve?

The country put on a show on the theme of artificial intelligence, which makes for excellent photos for social media and content for press releases. All that money, time and jet fuel spent could just have been an email.

You may also like

Internet

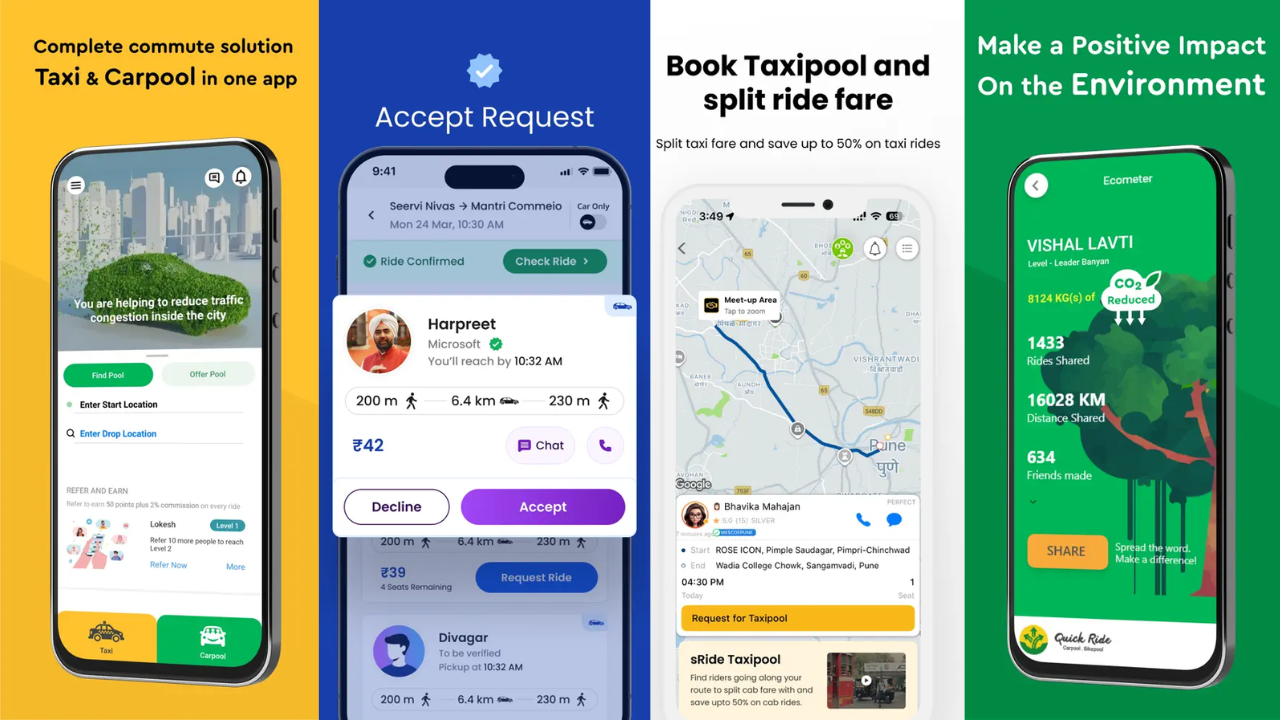

Inside the math of instant help startups

Millions of VC dollars are being splurged to service the last-minute needs of Indians—little revenue, increasing cash burn and far too many variables. At what point does it all come together?

Internet

Talabat slows down in December quarter, plans new investments

Delivery Hero-owned food delivery giant is seeing aggressive competition in multiple markets and has unveiled a new spending roadmap.

Internet

VC-funded startups are tempting women to join the instant house help business. Can it last?

In India’s instant house help sector, dominated by Snabbit, Pronto and Urban Company, domestic workers have nothing to lose and everything to gain. At least, for the time being.