The grind never ends: Nazara’s Manish Agarwal

The gaming company’s CEO talks about the transition to a publicly traded entity and lays bare the guts of the gaming business in India.

16 March, 2022•20 min

0

16 March, 2022•20 min

0

Getting your Trinity Audio player ready...

Why read this story?

Editor's note: Just shy of a year ago, Nazara Technologies went public with a stellar stock market debut. Unlike larger tech companies such as Paytm and Zomato, whose stocks have struggled, or Nykaa, whose quarterly performance has disappointed some investors, Mumbai-based Nazara has gone steady. Revenue continues to grow, while profits remain about the same. For those unfamiliar with Nazara, the company is actually a web of gaming companies, one which has been built on the back of mergers and acquisitions over the years. It runs a clutch of verticals operating in different segments within the larger gaming sector—esports, gamified learning (educational games for children), casual gaming, rummy and fantasy sport. Esports and gamified learning dominate, accounting for 84% of revenue. This past year has probably been its most important—new investments in different companies, a new vertical in the form of real-money gaming and a planned expansion to the Middle East. The 20-year-old company’s initial public offering was seen as a litmus test for the entire gaming industry. Twelve months on, it seems to have settled comfortably into its new reality as …

More in Internet

Internet

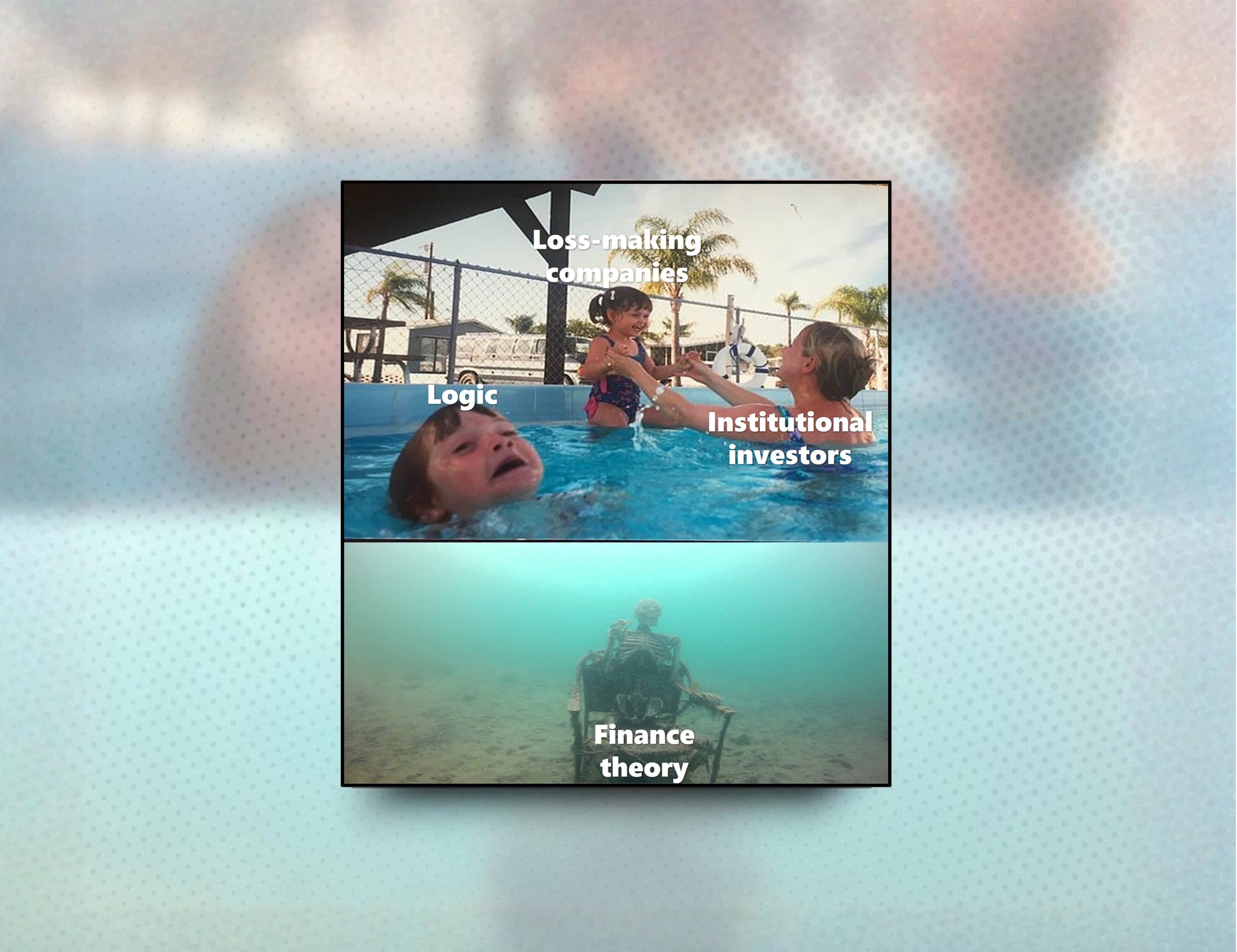

Inside the math of instant help startups

Millions of VC dollars are being splurged to service the last-minute needs of Indians—little revenue, increasing cash burn and far too many variables. At what point does it all come together?

You may also like

Business

Ten business developments for 2026

Who’s going to lead the IPO party, what’s going to drive the market, where are some of the leading businesses headed, and more.

Business

The Gulf Report: 2025 in review

A year when the Middle East secured a lead in AI, saw its public markets take a step towards maturity, attracted more and more hedge funds, among other highlights.

Business

How India’s retail shareholders are being left holding the can

Swiggy and Ola Electric’s plans to return to the public markets soon after big-bang IPOs leave investors with dilution, little prospect of returns and plenty of questions.