Canara Bank is a house divided

Two years into a merger with Syndicate Bank, there is little by way of synergy between the two banks and a lot of friction.

14 March, 2022•12 min

0

14 March, 2022•12 min

0

Getting your Trinity Audio player ready...

Why read this story?

Editor's note: When Syndicate Bank was folded into the larger Canara Bank, they were two among 10 public sector banks whose operations the government merged in April 2020, in spite of resistance from employee unions. On paper, it was supposed to help Canara Bank—the anchor bank in the merger—cement its slot as the fourth largest public sector bank in the country. Also, the government was hoping that merging a weaker Syndicate Bank with a stronger peer would help overcome the former’s lower capital adequacy and higher bad loan ratios. The fact that both shared Karnataka origins made it a match made in heaven. None of the other merged banks had this advantage. Two years on, the move seems to have backfired. On the one hand, the numbers don’t show any kind of synergy produced by the merger. On the other, friction between the employees of Canara Bank and the erstwhile Syndicate Bank has created a deep division in the ranks. All this finds reflection in lower productivity, with interest earned per employee down by 8% and total income per employee down by …

More in Business

Business

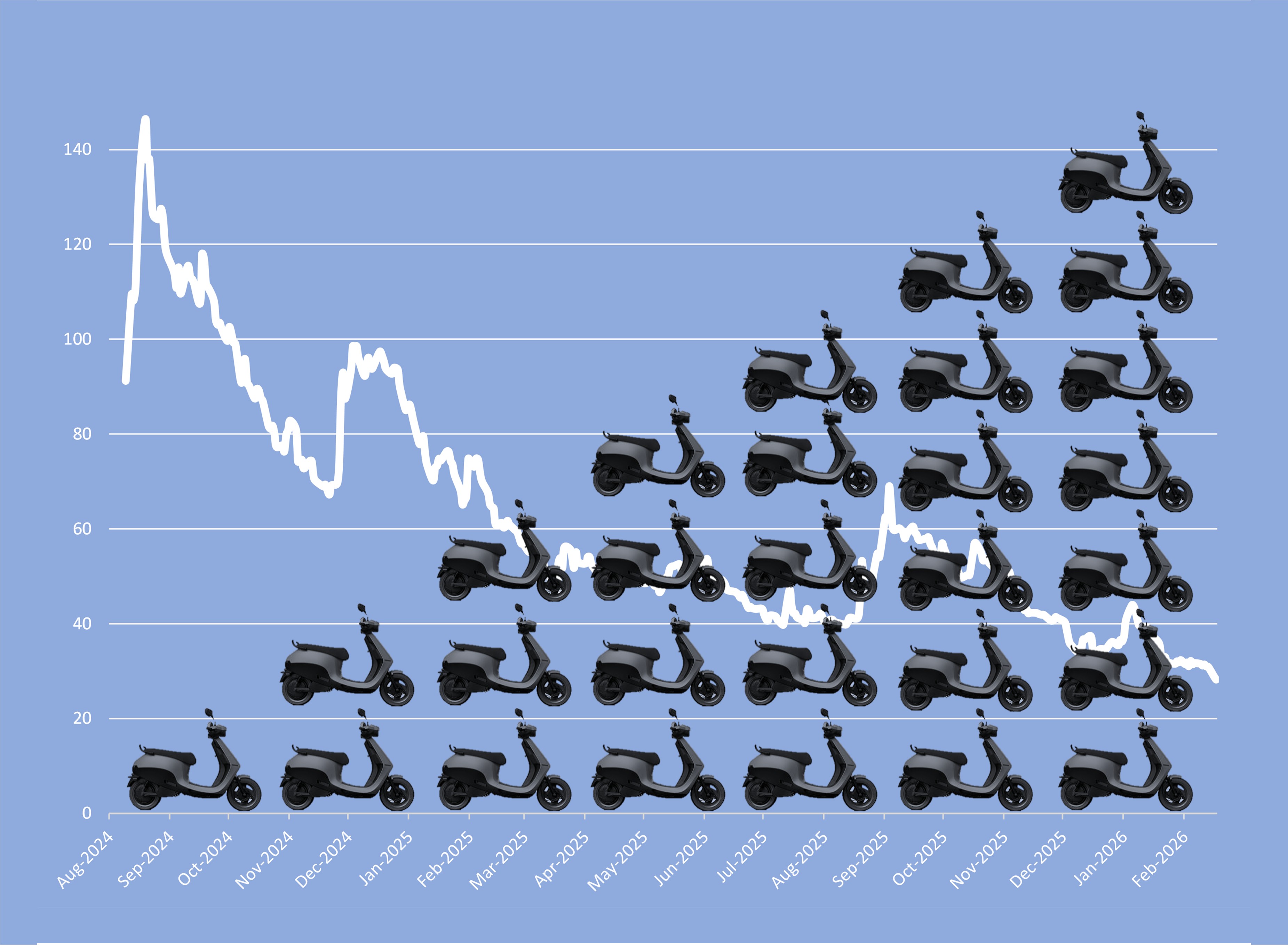

Motilal Oswal Mutual Fund’s inexplicable Ola Electric love

While its peers headed for the exit, the fund house doubled down on the falling stock. The contrarian call now looks expensive—and risky.

You may also like

Business

SBI Mutual Fund gains at the cost of its parent

India’s largest lender is going out of its way to grow its mutual fund business at the cost of shareholders, raising questions of corporate governance.

Business

Anil Ambani owes his gravy train ride to apathy, leniency

Multiple institutions have failed in their duty to pursue the litany of cases against Ambani and his companies. This has facilitated a comeback that should never have been

Business

Anil Ambani’s comeback is anything but one

The return to profitability and the deleveraging at Reliance Power and Reliance Infra are not what they’re cracked up to be. Plus, as their promoter, his past continues to haunt the two surviving group companies.