Friction #12: SEBI’s confusing exchange plans, Vedanta’s cheap bid

11 January, 2021•10 min

0

11 January, 2021•10 min

0

Getting your Trinity Audio player ready...

Why read this story?

Editor's note: Two important events from last week fit perfectly into Friction’s universe of corporate governance. On Wednesday, the Securities and Exchange Board of India issued a discussion paper (surprisingly low on details) to review “ownership and governance” of stock exchanges and depositories. On Saturday, Anil Agarwal-helmed Vedanta Ltd announced an open offer by its parent to acquire a 10% stake from public shareholders at a discount of 12% to the stock’s prevailing market price. Clearly, despite last year’s drama of a failed delisting and minority investors crying foul, nothing can deter the company from its chosen path of acquiring its shares cheaply. Turning the clock back? In a bare-bones, 10-page discussion paper, the markets regulator presented its policy intent—that it wants to undo the past decade’s slow and painstaking effort to shutter a plethora of regional stock exchanges and the clean-up of national exchanges brought about by diversifying ownership. Without providing data, reasoning or an explanation of the benefits of its proposals, SEBI is looking to revolutionize ownership of exchanges, which had earlier been mired in controversy, court battles and politics. …

More in Business

Business

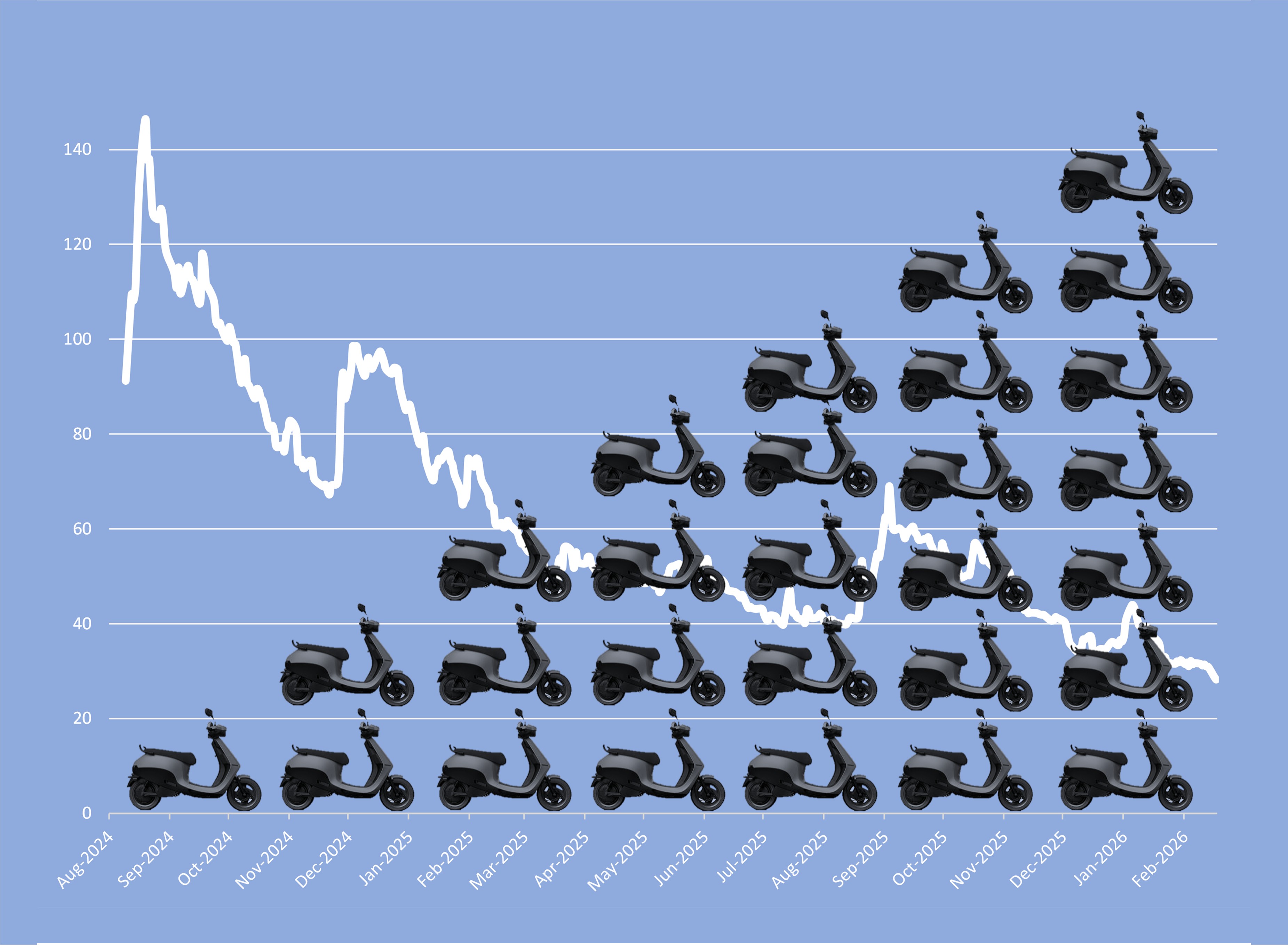

Motilal Oswal Mutual Fund’s inexplicable Ola Electric love

While its peers headed for the exit, the fund house doubled down on the falling stock. The contrarian call now looks expensive—and risky.

You may also like

Internet

Can SEBI get a good social media team for investor education?

With social media becoming a crucial source of financial guidance, it doesn’t help that many first-time investors remain strikingly unaware of regulations meant to protect them against unregistered entities.

Business

Mumbai's worsening garbage crisis, and the company in the thick of it

The Kanjurmarg landfill, operated by Antony Waste Handling Cell Ltd., is safe from the axe for now. But its fate remains a major source of worry for the company's shareholders and the city's residents alike.

Business

After Jane Street, SEBI to examine Millennium, Citadel trades

Jane Street’s alleged manipulation should not overshadow the fact that there is a lot more to the affair. Besides the US trading firm, NSE also needs to answer questions.