Ramdev hits pay dirt on the market

A successful offer for sale, soon after an FPO, helps his Patanjali group recoup nearly twice what it paid for acquiring Ruchi Soya.

19 July, 2023•7 min

0

19 July, 2023•7 min

0

Getting your Trinity Audio player ready...

More in Business

Business

Can Adani pull off the 100% green AI promise?

The group’s $100 billion data centre push rests on solving clean energy’s toughest constraint: consistent, real-time renewable supply at scale.

You may also like

Business

The hidden debt behind rural India’s ‘prosperity’

How well rural consumption is doing is subjective. What isn’t subjective is how growing indebtedness, combined with stagnant income growth, is creating a tinderbox for households, banks and consumer companies that no one is talking about.

Internet

Young consumer startups are forcing a reinvention of India’s FMCG giants

The country’s changing market dynamics are pushing consumer goods giants to acquire young startups. We look at why—and whether—it works for both sides.

Business

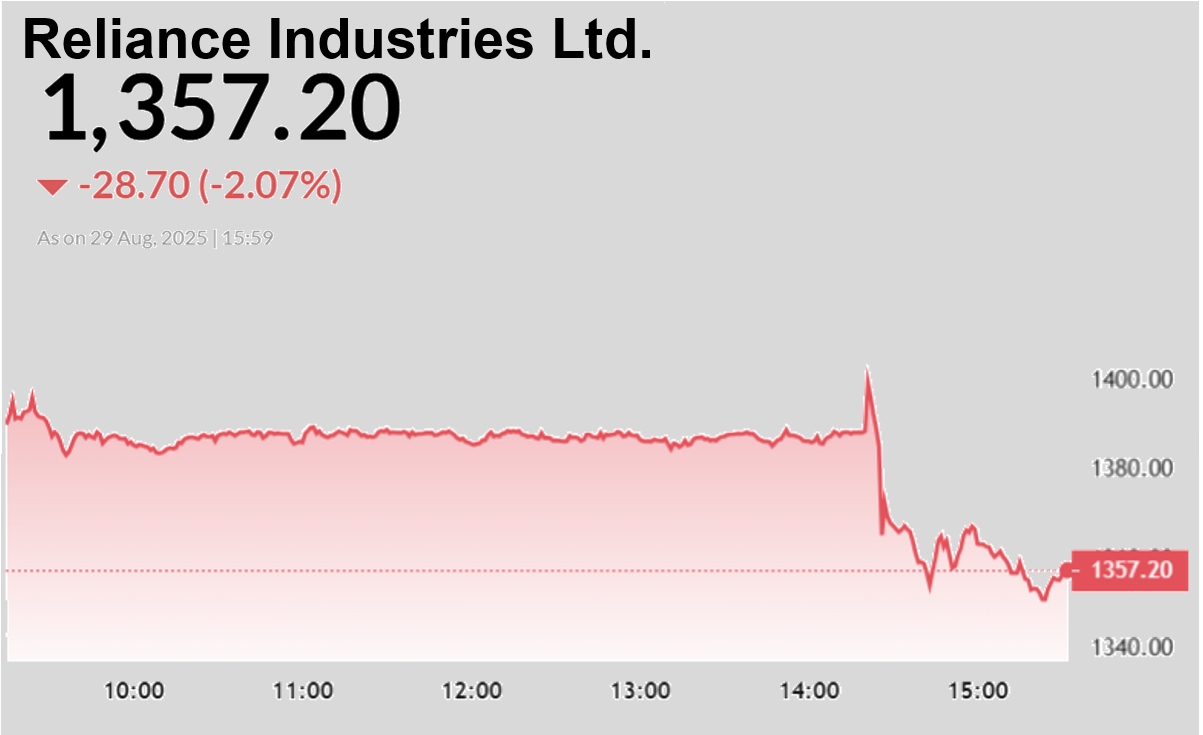

An uneventful Reliance AGM that could not have been otherwise

Everyone seems to be disappointed with the company’s annual general meeting. With hands full and businesses that need further nurturing, this was not the time for big-bang announcements. And so it was.