What explains Marico’s new-found aggression?

From launching products in segments with clear market leaders to nurturing startups, the objective is to get to Marico 2.0 in three years. Will CEO Saugata Gupta’s speed pay off?

11 November, 2021•14 min

0

11 November, 2021•14 min

0

Getting your Trinity Audio player ready...

Why read this story?

Editor's note: At Marico, the refrain seems to be about punching above one’s weight. In the 1990s, founder and chairman Harsh Mariwala managed to ward off competition and a near-hostile offer from packaged consumer goods biggie Hindustan Lever (now Hindustan Unilever Ltd, or HUL) to buy Parachute, Marico’s mainstay coconut hair oil brand. As Mariwala recounts in the recently released book, then Hindustan Lever chairman Keki Dadiseth even issued a not-so-veiled threat—“Marico will be history”—if the deal didn’t happen. Mariwala did not budge. Instead, later in 2006, he bought out Hindustan Lever’s Nihar hair oil brand in a stunning reversal of fortunes. Saugata Gupta, who was then two years into his stint at Marico as head of marketing, would have learnt a lesson or two from Mariwala’s unexpected victory over the industry goliath. Gupta had joined the company after stints at Cadbury (now Mondelez) and ICICI Prudential Life Insurance. At Marico, he had made an immediate impression, which saw him get elevated as the India CEO in 2007, and eventually take over from Mariwala as MD and CEO in 2014. Gupta may …

More in Business

Business

SEBI’s overdue expansion is underway, but top-level gaps persist

India’s market regulator is looking to ramp up hiring at the entry level. But what really needs attention is the constant uncertainty at the top and the lack of domain experts.

You may also like

Business

The hidden debt behind rural India’s ‘prosperity’

How well rural consumption is doing is subjective. What isn’t subjective is how growing indebtedness, combined with stagnant income growth, is creating a tinderbox for households, banks and consumer companies that no one is talking about.

Internet

Young consumer startups are forcing a reinvention of India’s FMCG giants

The country’s changing market dynamics are pushing consumer goods giants to acquire young startups. We look at why—and whether—it works for both sides.

Business

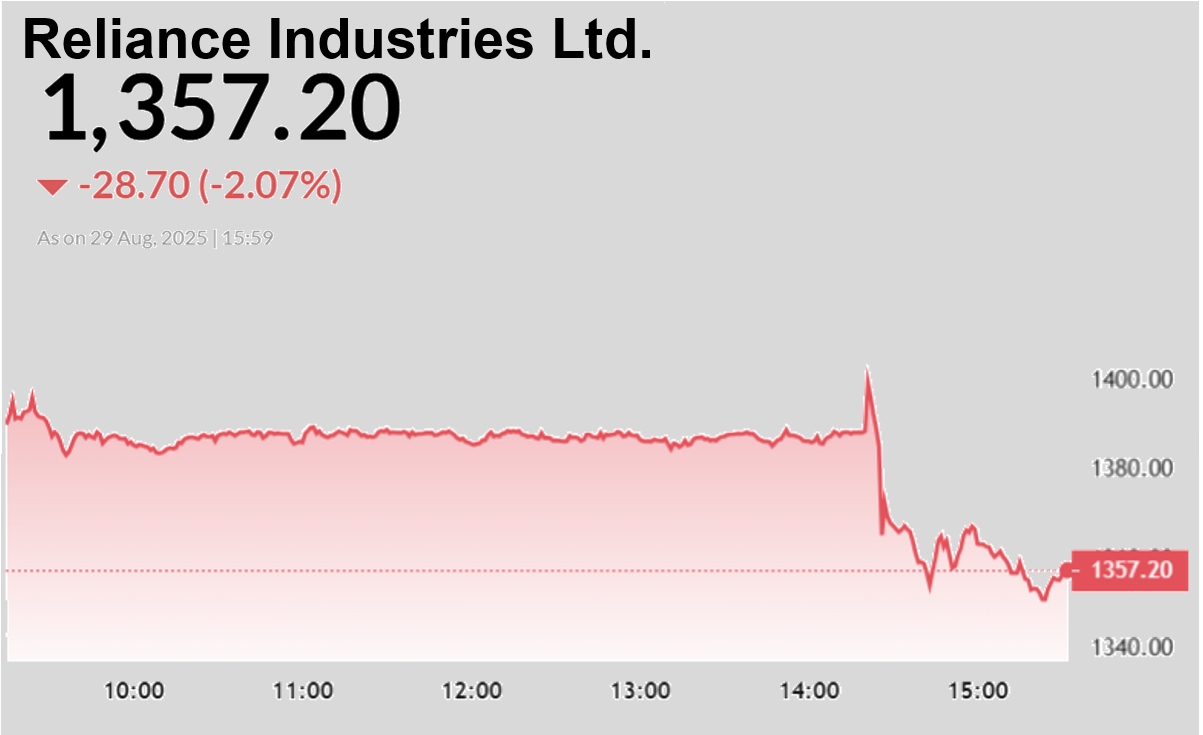

An uneventful Reliance AGM that could not have been otherwise

Everyone seems to be disappointed with the company’s annual general meeting. With hands full and businesses that need further nurturing, this was not the time for big-bang announcements. And so it was.