PharmEasy: A difficult prognosis

Parent API Holdings seems to be banking on FOMO to raise public money at 500% more than what it was valued at nine months ago.

22 November, 2021•15 min

0

22 November, 2021•15 min

0

Getting your Trinity Audio player ready...

Why read this story?

Editor's note: API Holdings, parent of online pharmacy platform PharmEasy, is on track to set a record for the fastest listing by a unicorn. In April this year, the company raised $350 million from investors, taking it past the billion dollar mark for the first time. Earlier this month, it filed its draft IPO prospectus to float a public issue in the current fiscal year itself. That, if it happens, will see beauty products company Nykaa—which became a $1 billion company in March last year and went on to list earlier this month—lose the tag for the fastest listing by a unicorn. Besides, API Holdings is not looking to raise any small sum. It wants to issue fresh equity to raise about $900 million. It last raised funds in October, to be valued at $5.6 billion, and is working on a pre-IPO placement that is likely to determine the final size and pricing of its issue. Trading in unlisted shares of the company values it at over $9 billion, a whopping 500% increase in the last nine months. The BSE Healthcare index, …

More in Internet

Internet

Beyond The MBA: Skills That Win Placements & Build Careers

Placement season is intense. But what makes a difference are the skills underlying your resume, which help both in landing a job and growing beyond it.

You may also like

Internet

Can Temu gain ground in the UAE?

The relatively new online marketplace seems to be doubling on its UAE momentum. We take a look at what is at stake.

Business

Ten business developments for 2026

Who’s going to lead the IPO party, what’s going to drive the market, where are some of the leading businesses headed, and more.

Business

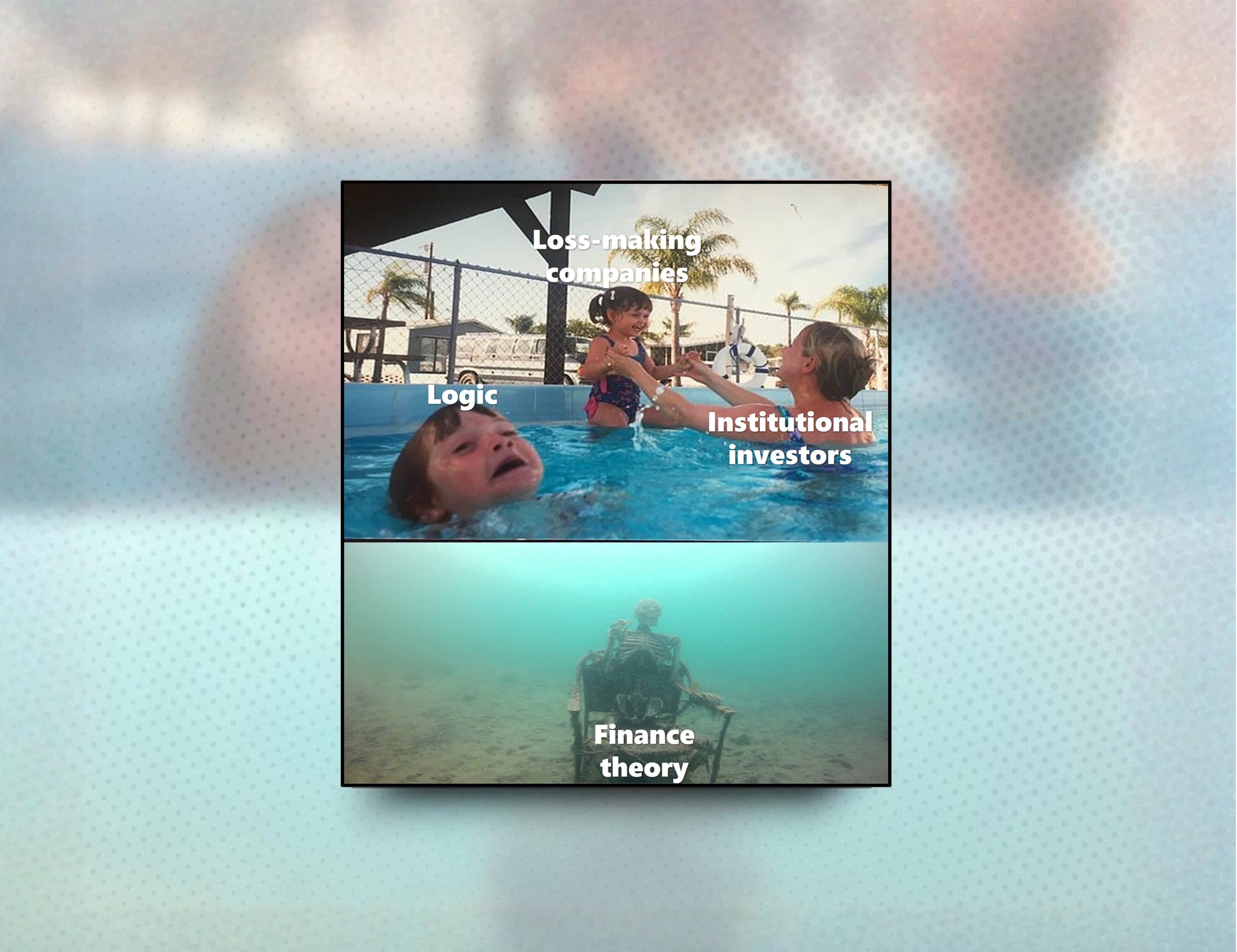

How India’s retail shareholders are being left holding the can

Swiggy and Ola Electric’s plans to return to the public markets soon after big-bang IPOs leave investors with dilution, little prospect of returns and plenty of questions.