AT&T’s spin-off and the lessons for Indian telcos

21 May, 2021•6 min

0

21 May, 2021•6 min

0

Getting your Trinity Audio player ready...

Why read this story?

Editor's note: This week delivered a big corporate update, the kind that usually sets a precedent for many others across the world. In one of the biggest spin-offs in corporate history, telecoms giant AT&T said that it will split out WarnerMedia—which owns HBO, CNN, TBS, TNT and Warner Bros. Studio, among others—and merge it with Discovery to form a new media company. This deal basically means that AT&T, which had acquired Time Warner (later renamed as WarnerMedia) three years ago in a $85 billion deal in the hopes of building a rival to the tech giants, is finally giving up on the idea of integrating content and distribution. The original idea behind the two big mergers was to help the Ma Bell descendant challenge Comcast Corp. in the pay-TV business, steal digital-advertising dollars from Alphabet Inc.’s Google, and mount a challenge to Netflix Inc. in streaming… Cable mogul John Malone, a major Discovery shareholder, said that although he believes Time Warner is doing fine, merging content and distribution usually doesn’t make sense. “I think that the technology of connectivity and digital technologies …

More in Internet

Internet

Bravado, IPO and OYO

A debt-heavy global pivot to modest motels and accounting-led profits define the company now heading to Indian public markets.

You may also like

Business

Reliance’s growth engines may be losing steam

Telecom and retail, which account for half the conglomerate’s revenue and most of its valuation, aren’t accelerating fast enough to justify their price tags.

Business

Abu Dhabi’s $16 billion push to become a finance magnet

Highlights from Abu Dhabi Finance Week, Qatar’s new (and bolder) AI ambition and the bid for Warner Bros. Discovery.

Internet

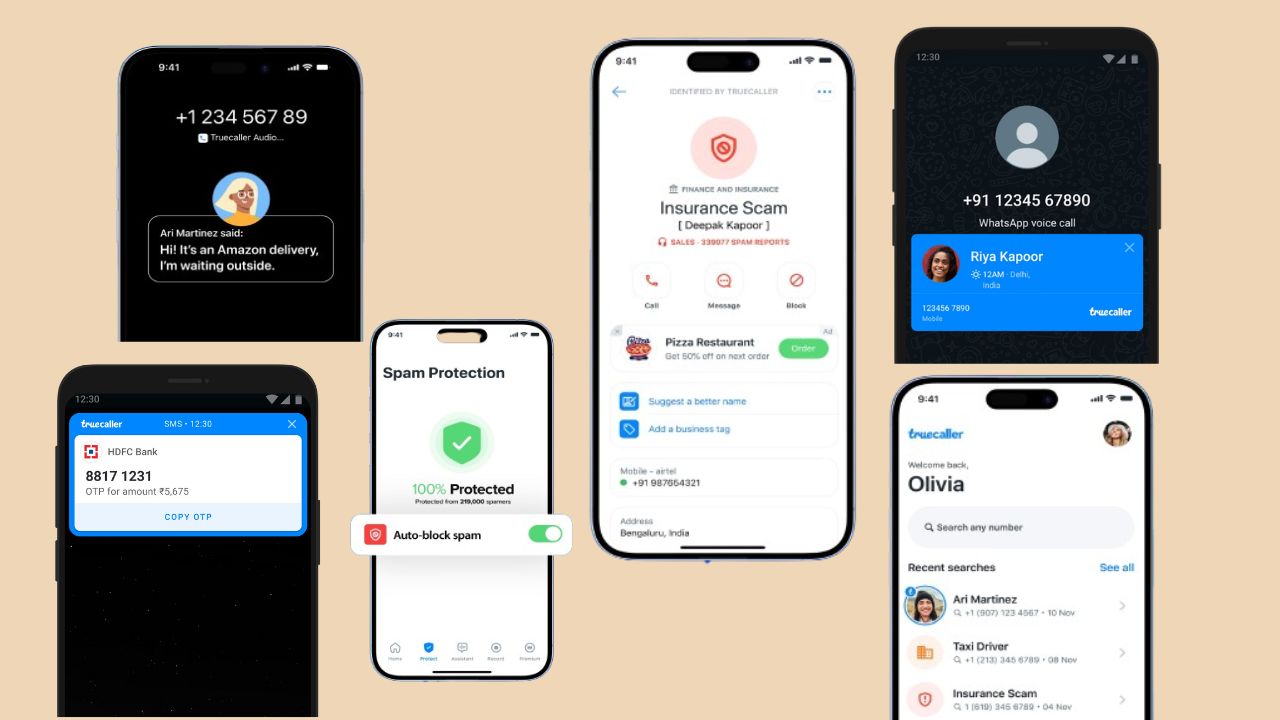

India made Truecaller a tech behemoth. Now it is slowly stifling the company

For over a decade, the Swedish caller ID company thrived on India’s lightly regulated digital ecosystem. Now, it faces some existential questions in its largest market.