Ramdev’s Patanjali Foods has lost its mojo

Though ayurveda helped Patanjali build a consumer goods brand, growth in recent years has plateaued. It’s time the company took quality, pricing and supply chain issues seriously.

14 March, 2023•9 min

0

14 March, 2023•9 min

0

Getting your Trinity Audio player ready...

Why read this story?

Editor's note: Baba Ramdev-backed Patanjali Foods, the packaged food business of Patanjali Ayurved that was earlier known as Ruchi Soya, seems to be losing its sheen. It was almost a year ago that Patanjali Ayurved merged its food business—comprising 21 products, including ghee, honey, spices, juices and flour—with Ruchi Soya, an edible oil company that it had acquired through the insolvency process in 2019. Last year, the yoga tycoon also set an ambitious target: To make Patanjali “India’s largest food and FMCG company in the next five years”. A year before that, he had claimed that Patanjali was only next to Hindustan Unilever, India’s largest consumer goods company, and would be No. 1 by 2025. But Patanjali’s food business seems to have slacked off after the rebranding exercise. Its revenue from operations fell 6.5% for the quarter ended December 2022 from the previous quarter. In contrast, Hindustan Unilever reported a 4% rise. Besides, Patanjali Foods’s EBITDA was merely a tenth of HUL’s in the third quarter of 2022-23. Its operating margin stood at 4.6% in the same period, while that of consumer …

More in Business

Business

SEBI’s overdue expansion is underway, but top-level gaps persist

India’s market regulator is looking to ramp up hiring at the entry level. But what really needs attention is the constant uncertainty at the top and the lack of domain experts.

You may also like

Business

The hidden debt behind rural India’s ‘prosperity’

How well rural consumption is doing is subjective. What isn’t subjective is how growing indebtedness, combined with stagnant income growth, is creating a tinderbox for households, banks and consumer companies that no one is talking about.

Internet

Young consumer startups are forcing a reinvention of India’s FMCG giants

The country’s changing market dynamics are pushing consumer goods giants to acquire young startups. We look at why—and whether—it works for both sides.

Business

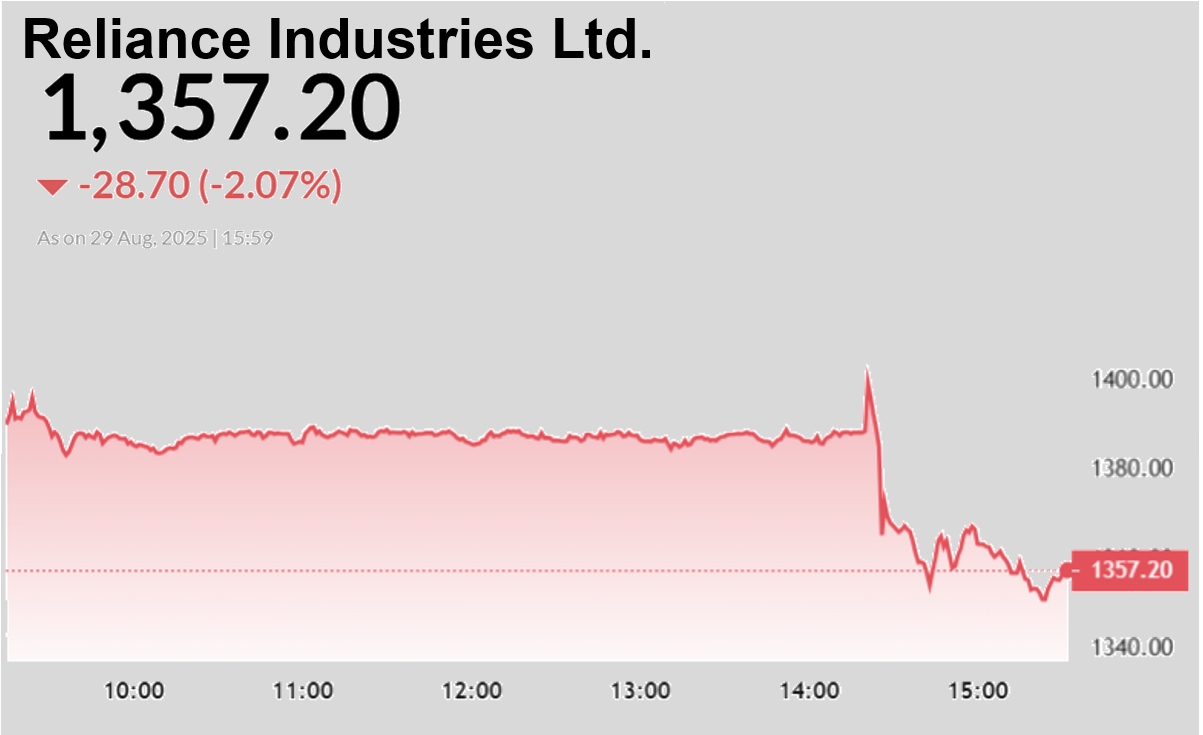

An uneventful Reliance AGM that could not have been otherwise

Everyone seems to be disappointed with the company’s annual general meeting. With hands full and businesses that need further nurturing, this was not the time for big-bang announcements. And so it was.