Airtel in talks to acquire Gaana

It has been a long and painful ride for India’s oldest music streaming company. A breather may be around the corner.

14 July, 2022•10 min

0

14 July, 2022•10 min

0

Why read this story?

Editor's note: For a few weeks now, Bharti Airtel has been in talks to acquire Gaana, India’s oldest and largest music streaming service, according to three people aware of the development. The talks are at an advanced stage and both companies are now negotiating the final valuation of the deal, according to one of the three people. Gaana, more than a decade old, is owned by Times Internet, the digital business of Bennett Coleman & Co. Ltd, better known as the Times Group, one of India’s largest media conglomerates. Gaana, though leads the sector, competes with the likes of Reliance-owned JioSaavn, global giant Spotify, Amazon’s Prime Music as well as Airtel’s own music streaming service Wynk Music. According to one of the three people quoted above, the negotiation for the deal is happening at the very top at Airtel, from the office of CEO Gopal Vittal himself. Vittal was also spearheading the launch and expansion of Wynk seven years ago and has personally been at the forefront of the content ambitions of India’s second largest telecom operator. If the deal goes through, …

More in Internet

Internet

VC-funded startups are tempting women to join the instant house help business. Can it last?

In India’s instant house help sector, dominated by Snabbit, Pronto and Urban Company, domestic workers have nothing to lose and everything to gain. At least, for the time being.

You may also like

Internet

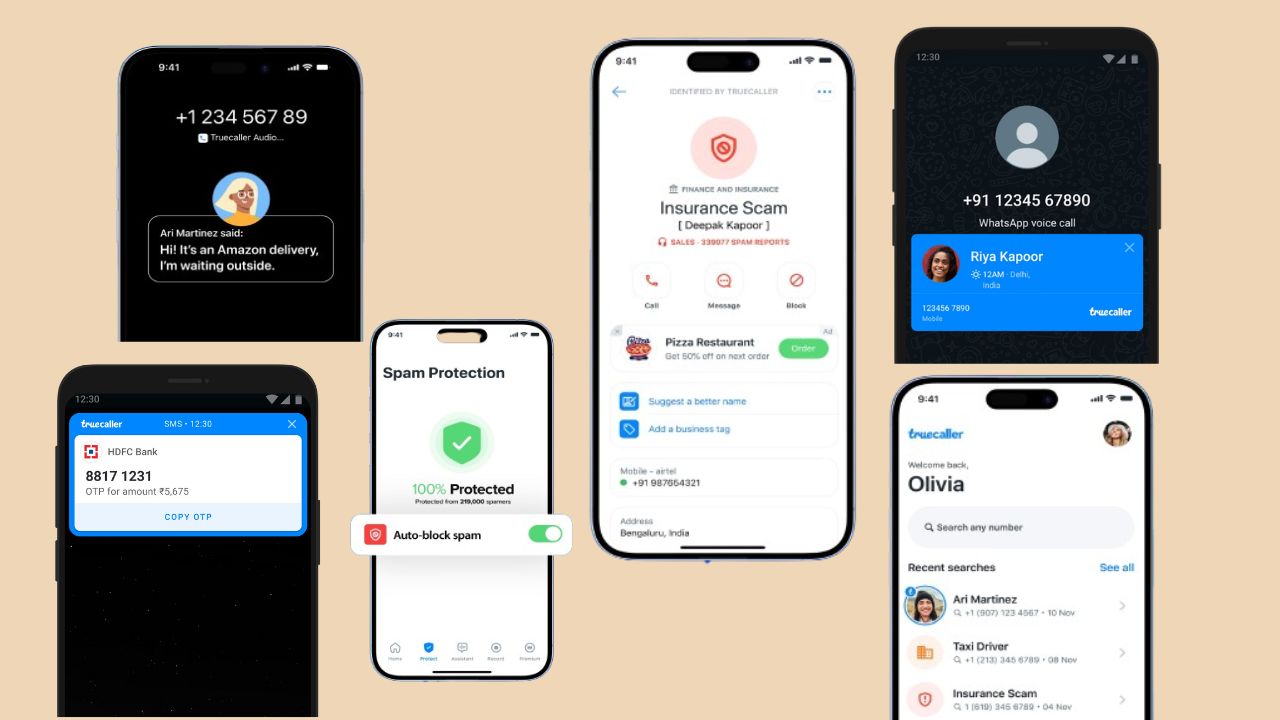

India made Truecaller a tech behemoth. Now it is slowly stifling the company

For over a decade, the Swedish caller ID company thrived on India’s lightly regulated digital ecosystem. Now, it faces some existential questions in its largest market.

Internet

Sanchar Saathi was never the cure

Even though the government of India did a U-turn on the mandatory pre-installation of the anti-fraud app on all mobile phones sold or imported in the country, the larger problem of petty cybercrime remains grim.

Internet

The Prasuma playbook: build slow, build well, sell right

Co-founder Lisa Suwal talks about how she scaled a family deli-meat business without a single rupee of venture capital and her decision to sell to ITC.